Issuer Free Writing Prospectus Dated May 17, 2022 Filed Pursuant to Rule 433 Registration No. 333-255475 ATAX Preferred Series A-1 Exchange Offering

Forward-Looking Statements This presentation incorporates information from a prospectus dated April 15, 2022, filed by America First Multifamily Investors, L.P. (the “Partnership”) with the Securities and Exchange Commission for the offering to which this communication relates (the “Prospectus”) and contains forward-looking statements. All statements in this document other than statements of historical facts, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. When used, statements which are not historical in nature, including those containing words such as “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are intended to identify forward-looking statements. We have based forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the headings “Risk Factors” beginning on page 21 of the Prospectus and page 14 of our Annual Report on Form 10-K for the year ended December 31, 2021. These forward-looking statements are subject to various risks and uncertainties and America First Multifamily Investors, L.P. expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Disclosure Regarding Non-GAAP Measures This document refers to certain financial measures that are identified as non-GAAP. The Partnership believes that these non-GAAP measures are helpful to investors because they are the key information used by management to analyze the Partnership’s operations. This information should not be considered in isolation or as a substitute for the related GAAP measures. A reconciliation of Non-GAAP measures to the most comparable GAAP measures can be found in Addendum C of this presentation.

Important Notices Free Writing Prospectus Statement America First Multifamily Investors, L.P. (“we,” “us,” “our,” or the “Partnership”) has filed a registration statement on Form S-4 (including a prospectus) and a post-effective amendment no. 1 to the Form S-4 (collectively, the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. The original registration statement on Form S-4 was declared effective by the SEC on July 6, 2021, and the post-effective amendment no.1 to the Form S-4, which contains the current prospectus, was declared effective by the SEC on April 13, 2022. Before you invest, you should read the prospectus in the Registration Statement and other documents the Partnership has filed with the SEC for more complete information about the Partnership and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Partnership will arrange to send you the prospectus if you request it by calling (855) 428-2951. Additional Disclosures There is no guarantee that any specific outcome will be achieved in connection with your investment in the Partnership. An investment in our Series A-1 Preferred Units involves risks. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information in the “Risk Factors” section of the prospectus included in the post-effective amendment no.1 to the Registration Statement, which was declared effective by the SEC on April 13, 2022.

ATAX Preferred – Performance Summary Original Investment Thesis: To provide US depository institutions with an investment likely to receive positive CRA consideration, while generating income, distributing cash and providing an allocation of investment capital to specific Community development investments. Furthermore, the investment should reduce risk through portfolio diversification and seniority within the fund capital stack. Preferred Series A Unit Performance Summary: $94.5 million of Preferred Series A Capital deployed between Q1 2016 – Q4 2017 5 Investors made 9 separate rounds of investment $20 million of Series A Preferred Units exchanged for Series A-1 Preferred Units All Preferred Unit distributions have been made in full and on time CRA allocations managed across 32 different allocation requests From Q1 2016 through Q1 2022*, ATAX provided financing: For 42 additional Community Development Investments In 10 states and 26 different counties Representing 6,269 Total Units *Please see Addendum B: Community Development Investments Q1 2016 – Q1 2022

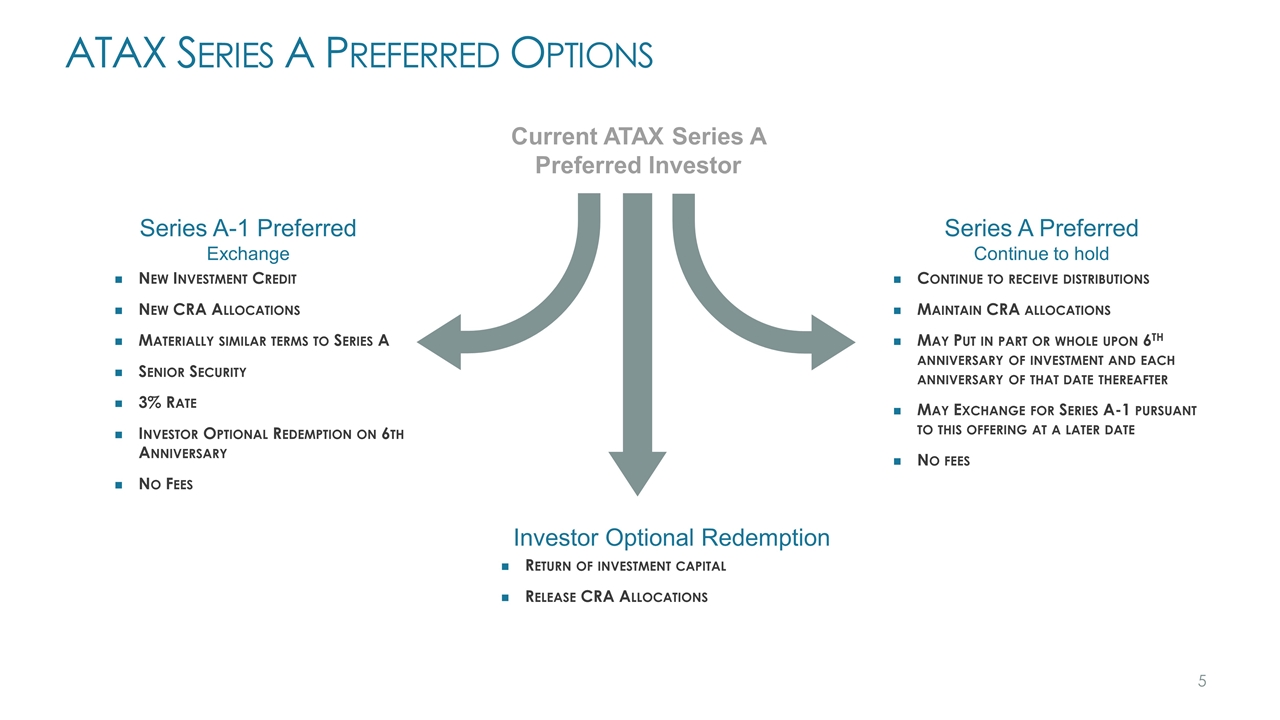

ATAX Series A Preferred Options Current ATAX Series A Preferred Investor Series A-1 Preferred Exchange New Investment Credit New CRA Allocations Materially similar terms to Series A Senior Security 3% Rate Investor Optional Redemption on 6th Anniversary No Fees Series A Preferred Continue to hold Continue to receive distributions Maintain CRA allocations May Put in part or whole upon 6th anniversary of investment and each anniversary of that date thereafter May Exchange for Series A-1 pursuant to this offering at a later date No fees Investor Optional Redemption Return of investment capital Release CRA Allocations

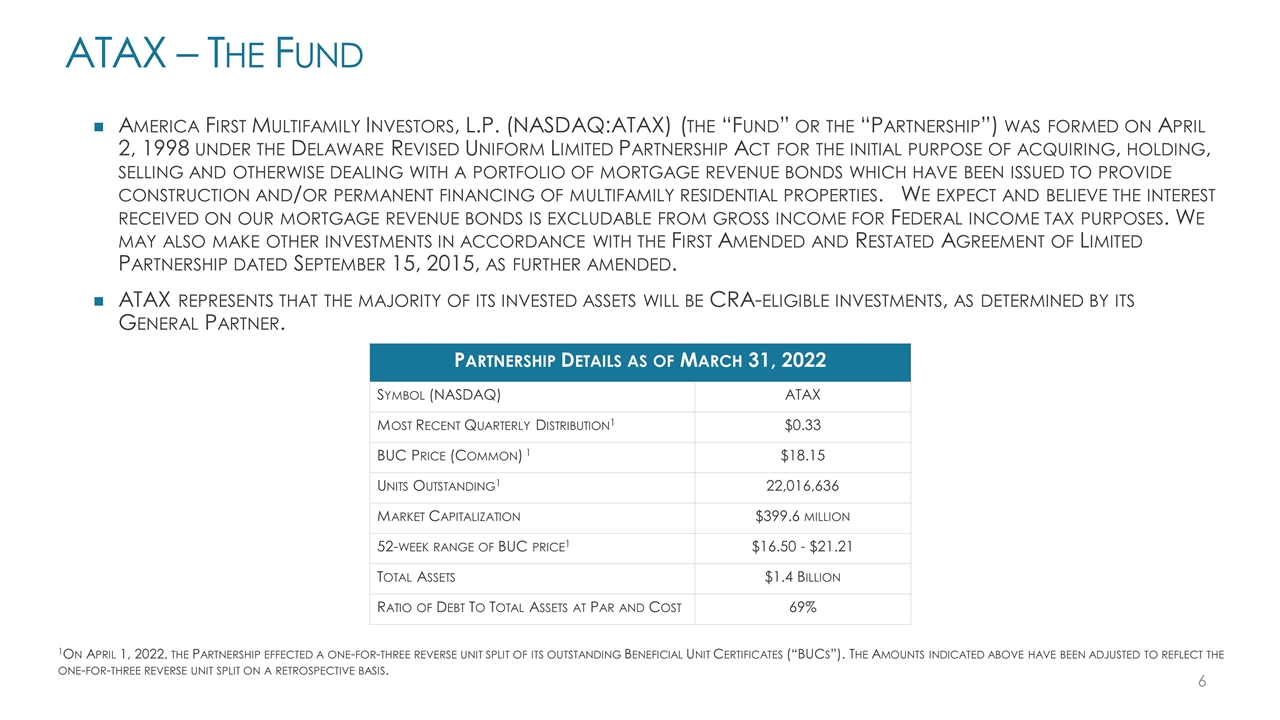

ATAX – The Fund America First Multifamily Investors, L.P. (NASDAQ:ATAX) (the “Fund” or the “Partnership”) was formed on April 2, 1998 under the Delaware Revised Uniform Limited Partnership Act for the initial purpose of acquiring, holding, selling and otherwise dealing with a portfolio of mortgage revenue bonds which have been issued to provide construction and/or permanent financing of multifamily residential properties. We expect and believe the interest received on our mortgage revenue bonds is excludable from gross income for Federal income tax purposes. We may also make other investments in accordance with the First Amended and Restated Agreement of Limited Partnership dated September 15, 2015, as further amended. ATAX represents that the majority of its invested assets will be CRA-eligible investments, as determined by its General Partner. Partnership Details as of March 31, 2022 Symbol (NASDAQ) ATAX Most Recent Quarterly Distribution1 $0.33 BUC Price (Common) 1 $18.15 Units Outstanding1 22,016,636 Market Capitalization $399.6 million 52-week range of BUC price1 $16.50 - $21.21 Total Assets $1.4 Billion Ratio of Debt To Total Assets at Par and Cost 69% 1On April 1, 2022, the Partnership effected a one-for-three reverse unit split of its outstanding Beneficial Unit Certificates (“BUCs”). The Amounts indicated above have been adjusted to reflect the one-for-three reverse unit split on a retrospective basis.

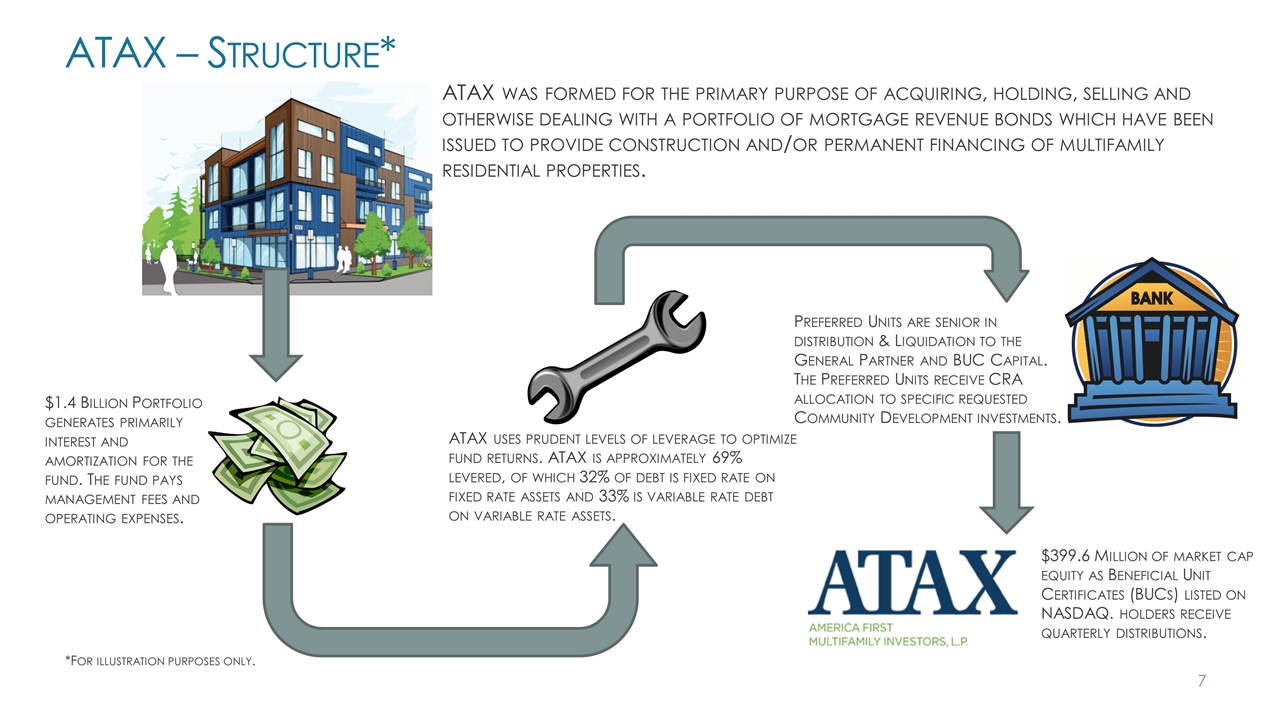

ATAX – Structure* ATAX was formed for the primary purpose of acquiring, holding, selling and otherwise dealing with a portfolio of mortgage revenue bonds which have been issued to provide construction and/or permanent financing of multifamily residential properties. $1.4 Billion Portfolio generates primarily interest and amortization for the fund. The fund pays management fees and operating expenses. ATAX uses prudent levels of leverage to optimize fund returns. ATAX is approximately 69% levered, of which 32% of debt is fixed rate on fixed rate assets and 33% is variable rate debt on variable rate assets. Preferred Units are senior in distribution & Liquidation to the General Partner and BUC Capital. The Preferred Units receive CRA allocation to specific requested Community Development investments. $399.6 Million of market cap equity as Beneficial Unit Certificates (BUCs) listed on NASDAQ. holders receive quarterly distributions. *For illustration purposes only.

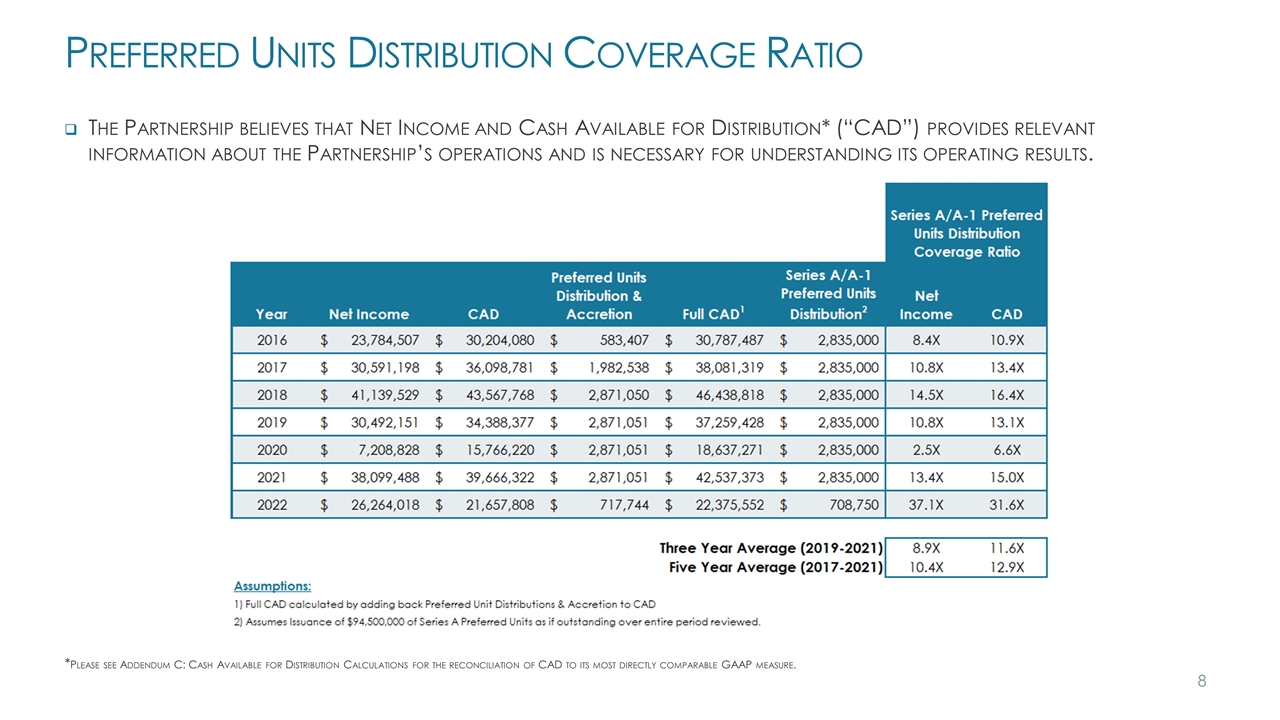

Preferred Units Distribution Coverage Ratio The Partnership believes that Net Income and Cash Available for Distribution* (“CAD”) provides relevant information about the Partnership’s operations and is necessary for understanding its operating results. *Please see Addendum C: Cash Available for Distribution Calculations for the reconciliation of CAD to its most directly comparable GAAP measure.

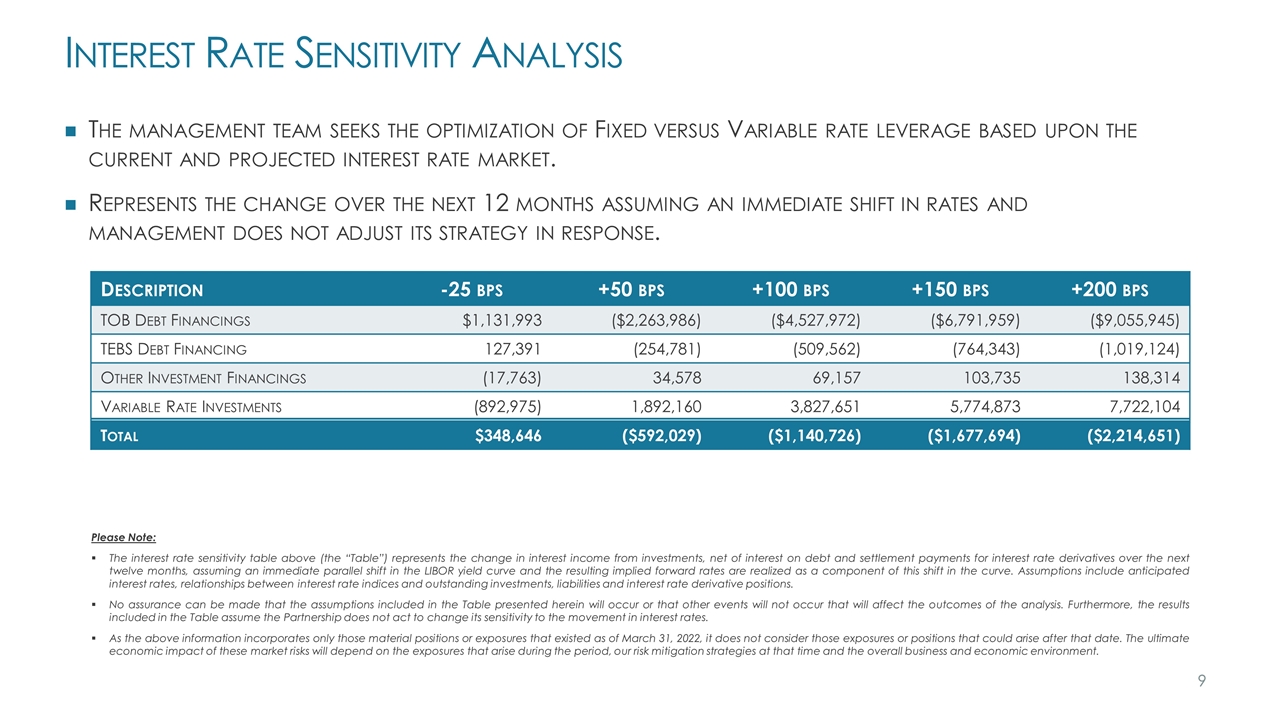

Interest Rate Sensitivity Analysis The management team seeks the optimization of Fixed versus Variable rate leverage based upon the current and projected interest rate market. Represents the change over the next 12 months assuming an immediate shift in rates and management does not adjust its strategy in response. Description -25 bps +50 bps +100 bps +150 bps +200 bps TOB Debt Financings $1,131,993 ($2,263,986) ($4,527,972) ($6,791,959) ($9,055,945) TEBS Debt Financing 127,391 (254,781) (509,562) (764,343) (1,019,124) Other Investment Financings (17,763) 34,578 69,157 103,735 138,314 Variable Rate Investments (892,975) 1,892,160 3,827,651 5,774,873 7,722,104 Total $348,646 ($592,029) ($1,140,726) ($1,677,694) ($2,214,651) Please Note: The interest rate sensitivity table above (the “Table”) represents the change in interest income from investments, net of interest on debt and settlement payments for interest rate derivatives over the next twelve months, assuming an immediate parallel shift in the LIBOR yield curve and the resulting implied forward rates are realized as a component of this shift in the curve. Assumptions include anticipated interest rates, relationships between interest rate indices and outstanding investments, liabilities and interest rate derivative positions. No assurance can be made that the assumptions included in the Table presented herein will occur or that other events will not occur that will affect the outcomes of the analysis. Furthermore, the results included in the Table assume the Partnership does not act to change its sensitivity to the movement in interest rates. As the above information incorporates only those material positions or exposures that existed as of March 31, 2022, it does not consider those exposures or positions that could arise after that date. The ultimate economic impact of these market risks will depend on the exposures that arise during the period, our risk mitigation strategies at that time and the overall business and economic environment.

Community Development Investments The majority of the Fund’s invested assets are CRA-eligible investments (“Community Development Investments” or “CDI”). CRA Majority of Invested Assets Certification provided at close. Annual CRA Majority of Invested Assets Certification provided thereafter. The General Partner determines CDI’s where the majority of underlying units are restricted to those earning less than 80% of Area Median Income (“AMI”). Low Income Housing Tax Credit multifamily housing. 501(c)(3) Income Restricted multifamily housing. CDI specific allocation, portfolio diversified risk. Equity allocated to specific CDI(s) for reporting purposes. Strict control of CRA allocations to ensure no overlap. Economic risk spread across the entire fund portfolio. Regulatory approval received by Preferred Unit Investors. Bruton Apartments Dallas, TX $18.14 Million Senior Bond 100% @ 60% AMI Seasons At Simi Valley Simi Valley, CA $4.4 Million Senior Bond 40% @ 40% & 60% @ 50% AMI Bridle Ridge Apartments Greer, SC $7.9 Million Senior Bond 100% @ 60% AMI Illustrative transactions

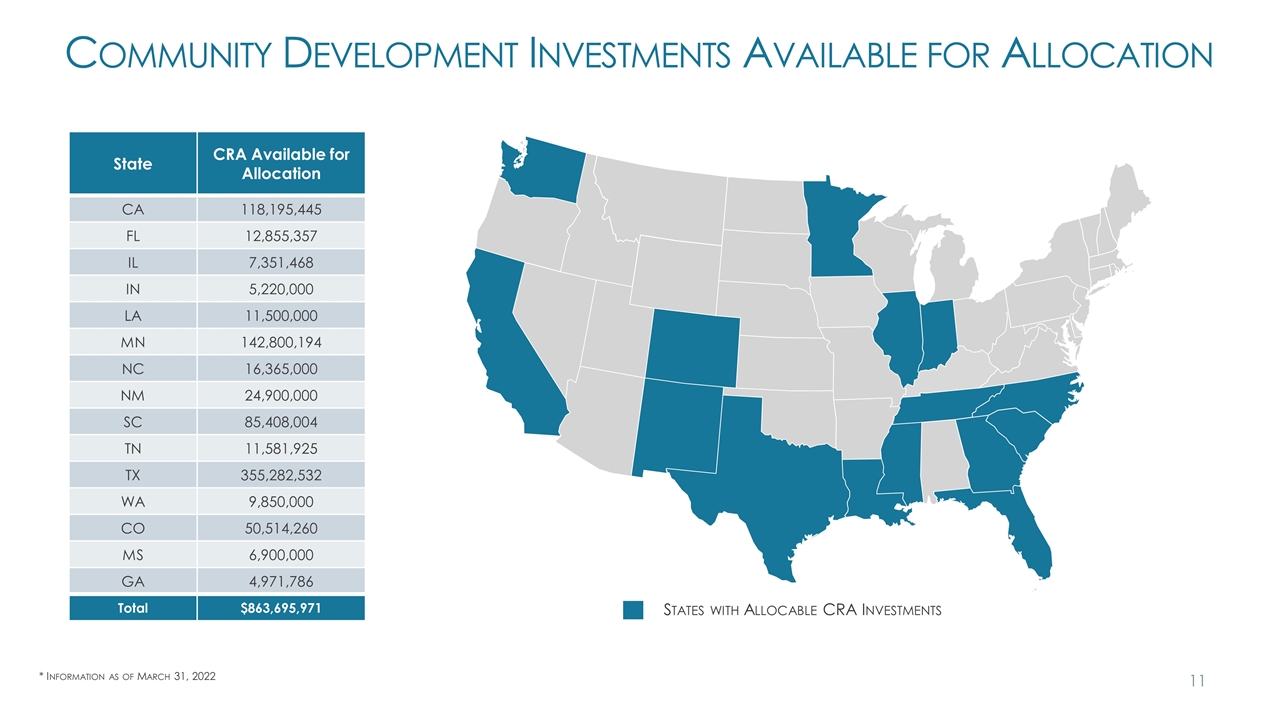

Community Development Investments Available for Allocation States with Allocable CRA Investments * Information as of March 31, 2022 State CRA Available for Allocation CA 118,195,445 FL 12,855,357 IL 7,351,468 IN 5,220,000 LA 11,500,000 MN 142,800,194 NC 16,365,000 NM 24,900,000 SC 85,408,004 TN 11,581,925 TX 355,282,532 WA 9,850,000 CO 50,514,260 MS 6,900,000 GA 4,971,786 Total $863,695,971

The Management Team We approach multifamily real estate as long-term owners and managers. Based in Omaha, Nebraska, the core team of real estate professionals executes ATAX’s fundamental long-term strategy. Our in-depth knowledge of the industry, from development to property management, combined with our proven and verifiable track record of success, is a testament of the commitment and dedication we bring to each property. The General Partner that manages ATAX’s operations is a wholly owned subsidiary of Greystone. Key features of each of our real estate investments includes: Safety and preservation of capital. Predictable current cash distributions/yields. Potential for enhanced yield/capital appreciation. Expertise Multifamily Ownership Affordable Housing Seniors and Skilled Nursing Facilities Multifamily Property Management Student Housing

Greystone Greystone, founded in 1988, is a national commercial real estate lending, investment and advisory firm headquartered in New York with offices in 34 states, and over 1,500 employees. Greystone is a leading multifamily and healthcare lender, having originated $18.3 billion in 2021. Greystone’s real estate finance capabilities provide flexible capital solutions across a variety of platforms including Fannie Mae, Freddie Mac, FHA, CMBS, Bridge, Mezzanine, and Preferred equity. Clear market leader in restructuring defaulted Federal Housing Administration (FHA) multifamily loans. #1 2021 FHA multifamily loan originator in number of loans for multifamily and healthcare combined. #2 2021 small loan Fannie Mae Delegated Underwriter and Servicing (DUS®) lender in the United States. Greystone’s real estate investment businesses include real estate development; acquisition and management of multifamily housing; affordable housing and healthcare facilities. Greystone’s real estate advisory businesses offer a range of specialties, including multifamily and healthcare sales advisory, affordable housing preservation, and development management.

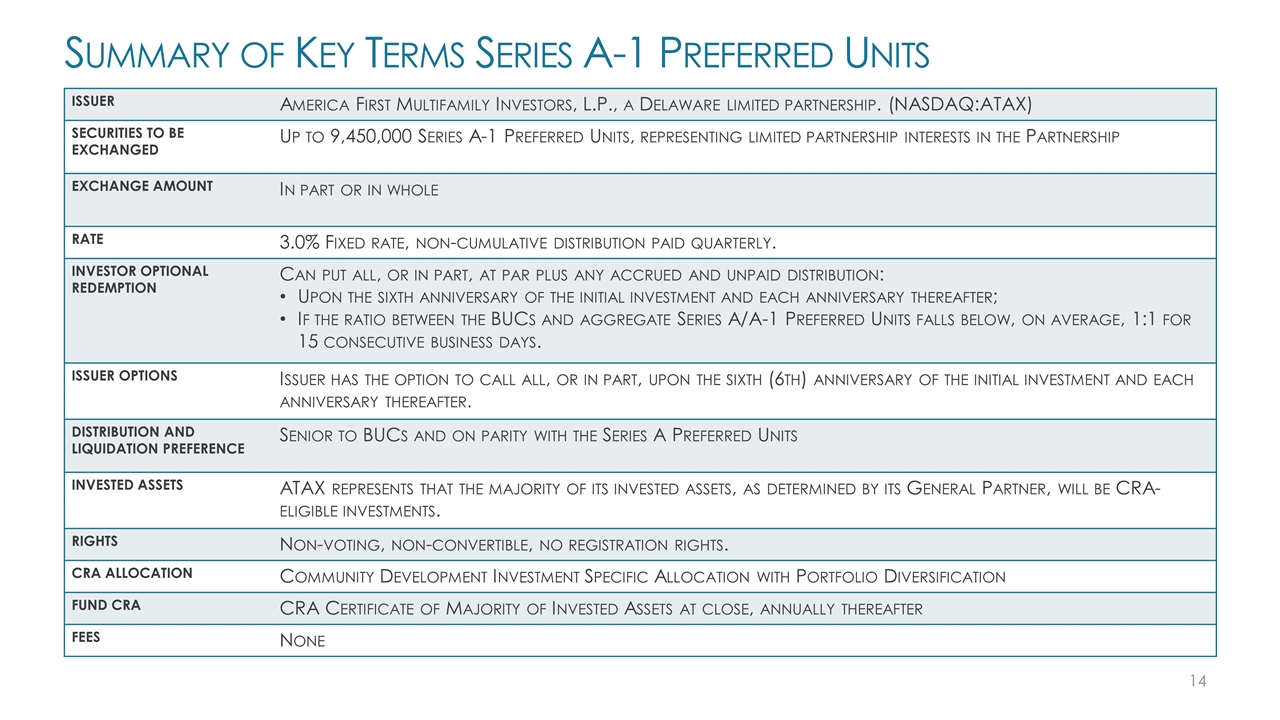

Summary of Key Terms Series A-1 Preferred Units ISSUER America First Multifamily Investors, L.P., a Delaware limited partnership. (NASDAQ:ATAX) SECURITIES TO BE EXCHANGED Up to 9,450,000 Series A-1 Preferred Units, representing limited partnership interests in the Partnership EXCHANGE AMOUNT In part or in whole RATE 3.0% Fixed rate, non-cumulative distribution paid quarterly. INVESTOR OPTIONAL REDEMPTION Can put all, or in part, at par plus any accrued and unpaid distribution: Upon the sixth anniversary of the initial investment and each anniversary thereafter; If the ratio between the BUCs and aggregate Series A/A-1 Preferred Units falls below, on average, 1:1 for 15 consecutive business days. ISSUER OPTIONS Issuer has the option to call all, or in part, upon the sixth (6th) anniversary of the initial investment and each anniversary thereafter. DISTRIBUTION AND LIQUIDATION PREFERENCE Senior to BUCs and on parity with the Series A Preferred Units INVESTED ASSETS ATAX represents that the majority of its invested assets, as determined by its General Partner, will be CRA-eligible investments. RIGHTS Non-voting, non-convertible, no registration rights. CRA ALLOCATION Community Development Investment Specific Allocation with Portfolio Diversification FUND CRA CRA Certificate of Majority of Invested Assets at close, annually thereafter FEES None

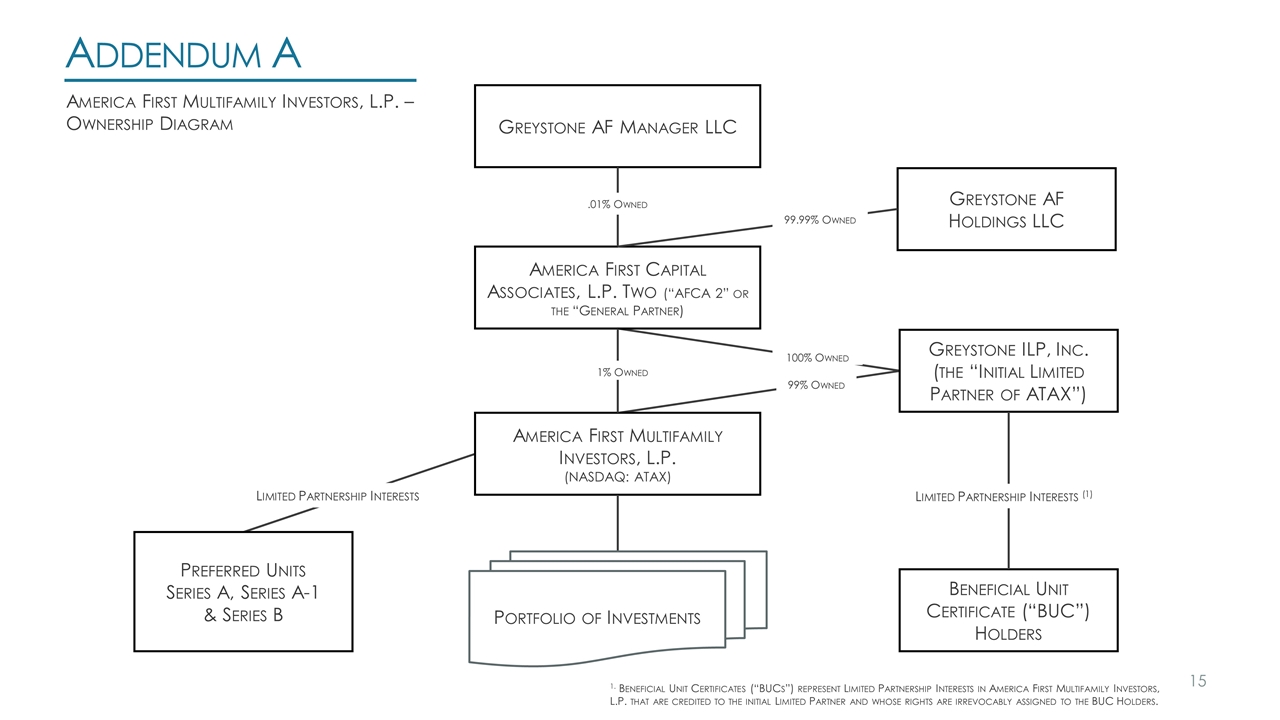

Addendum A Greystone AF Manager LLC America First Capital Associates, L.P. Two (“AFCA 2” or the “General Partner) America First Multifamily Investors, L.P. (NASDAQ: ATAX) Limited Partnership Interests Preferred Units Series A, Series A-1 & Series B Greystone AF Holdings LLC Greystone ILP, Inc. (the “Initial Limited Partner of ATAX”) Beneficial Unit Certificate (“BUC”) Holders 100% Owned 99% Owned Limited Partnership Interests (1) 99.99% Owned .01% Owned 1% Owned 1. Beneficial Unit Certificates (“BUCs”) represent Limited Partnership Interests in America First Multifamily Investors, L.P. that are credited to the initial Limited Partner and whose rights are irrevocably assigned to the BUC Holders. Portfolio of Investments America First Multifamily Investors, L.P. – Ownership Diagram

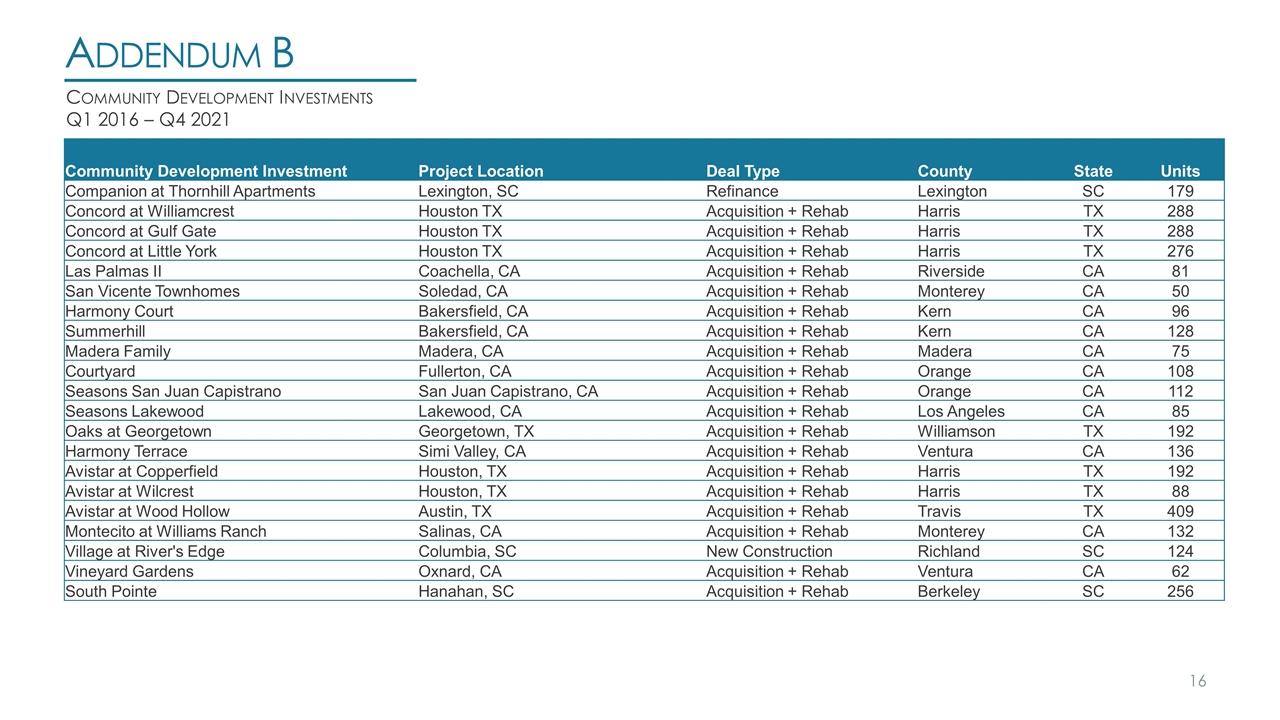

Addendum B Community Development Investments Q1 2016 – Q4 2021 Community Development Investment Project Location Deal Type County State Units Companion at Thornhill Apartments Lexington, SC Refinance Lexington SC 179 Concord at Williamcrest Houston TX Acquisition + Rehab Harris TX 288 Concord at Gulf Gate Houston TX Acquisition + Rehab Harris TX 288 Concord at Little York Houston TX Acquisition + Rehab Harris TX 276 Las Palmas II Coachella, CA Acquisition + Rehab Riverside CA 81 San Vicente Townhomes Soledad, CA Acquisition + Rehab Monterey CA 50 Harmony Court Bakersfield, CA Acquisition + Rehab Kern CA 96 Summerhill Bakersfield, CA Acquisition + Rehab Kern CA 128 Madera Family Madera, CA Acquisition + Rehab Madera CA 75 Courtyard Fullerton, CA Acquisition + Rehab Orange CA 108 Seasons San Juan Capistrano San Juan Capistrano, CA Acquisition + Rehab Orange CA 112 Seasons Lakewood Lakewood, CA Acquisition + Rehab Los Angeles CA 85 Oaks at Georgetown Georgetown, TX Acquisition + Rehab Williamson TX 192 Harmony Terrace Simi Valley, CA Acquisition + Rehab Ventura CA 136 Avistar at Copperfield Houston, TX Acquisition + Rehab Harris TX 192 Avistar at Wilcrest Houston, TX Acquisition + Rehab Harris TX 88 Avistar at Wood Hollow Austin, TX Acquisition + Rehab Travis TX 409 Montecito at Williams Ranch Salinas, CA Acquisition + Rehab Monterey CA 132 Village at River's Edge Columbia, SC New Construction Richland SC 124 Vineyard Gardens Oxnard, CA Acquisition + Rehab Ventura CA 62 South Pointe Hanahan, SC Acquisition + Rehab Berkeley SC 256

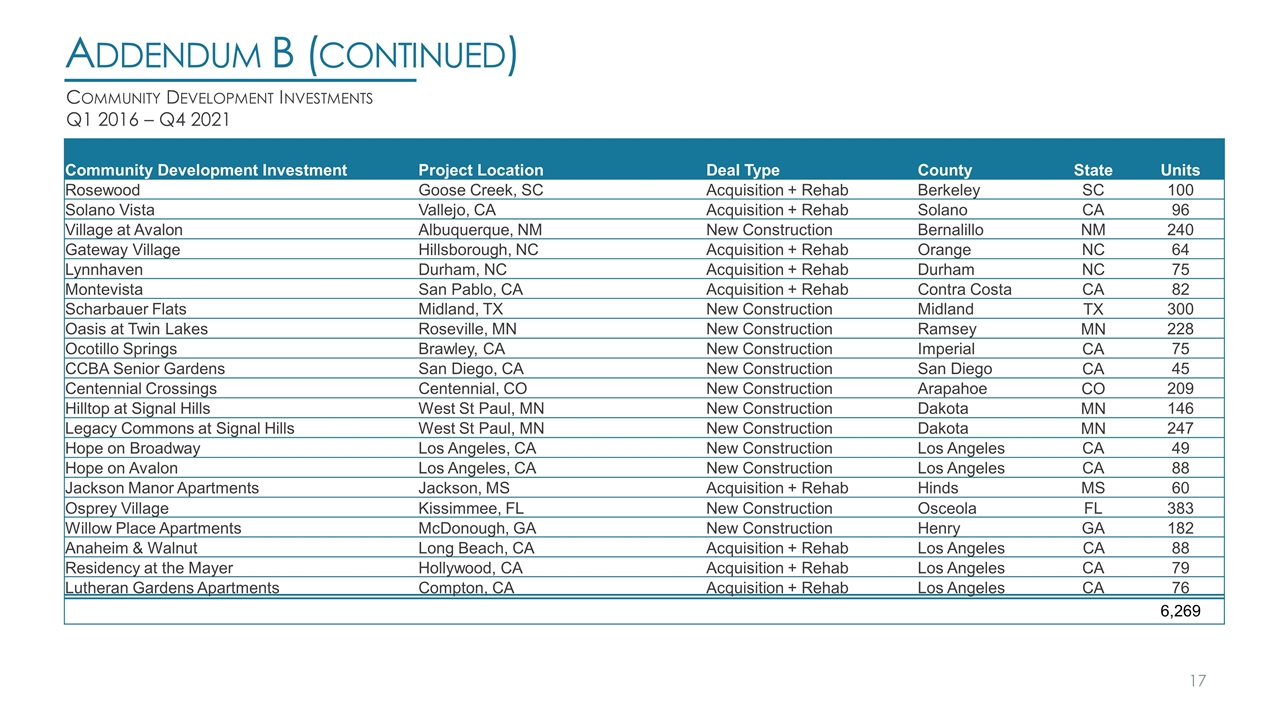

Addendum B (continued) Community Development Investments Q1 2016 – Q4 2021 Community Development Investment Project Location Deal Type County State Units Rosewood Goose Creek, SC Acquisition + Rehab Berkeley SC 100 Solano Vista Vallejo, CA Acquisition + Rehab Solano CA 96 Village at Avalon Albuquerque, NM New Construction Bernalillo NM 240 Gateway Village Hillsborough, NC Acquisition + Rehab Orange NC 64 Lynnhaven Durham, NC Acquisition + Rehab Durham NC 75 Montevista San Pablo, CA Acquisition + Rehab Contra Costa CA 82 Scharbauer Flats Midland, TX New Construction Midland TX 300 Oasis at Twin Lakes Roseville, MN New Construction Ramsey MN 228 Ocotillo Springs Brawley, CA New Construction Imperial CA 75 CCBA Senior Gardens San Diego, CA New Construction San Diego CA 45 Centennial Crossings Centennial, CO New Construction Arapahoe CO 209 Hilltop at Signal Hills West St Paul, MN New Construction Dakota MN 146 Legacy Commons at Signal Hills West St Paul, MN New Construction Dakota MN 247 Hope on Broadway Los Angeles, CA New Construction Los Angeles CA 49 Hope on Avalon Los Angeles, CA New Construction Los Angeles CA 88 Jackson Manor Apartments Jackson, MS Acquisition + Rehab Hinds MS 60 Osprey Village Kissimmee, FL New Construction Osceola FL 383 Willow Place Apartments McDonough, GA New Construction Henry GA 182 Anaheim & Walnut Long Beach, CA Acquisition + Rehab Los Angeles CA 88 Residency at the Mayer Hollywood, CA Acquisition + Rehab Los Angeles CA 79 Lutheran Gardens Apartments Compton, CA Acquisition + Rehab Los Angeles CA 76 6,269

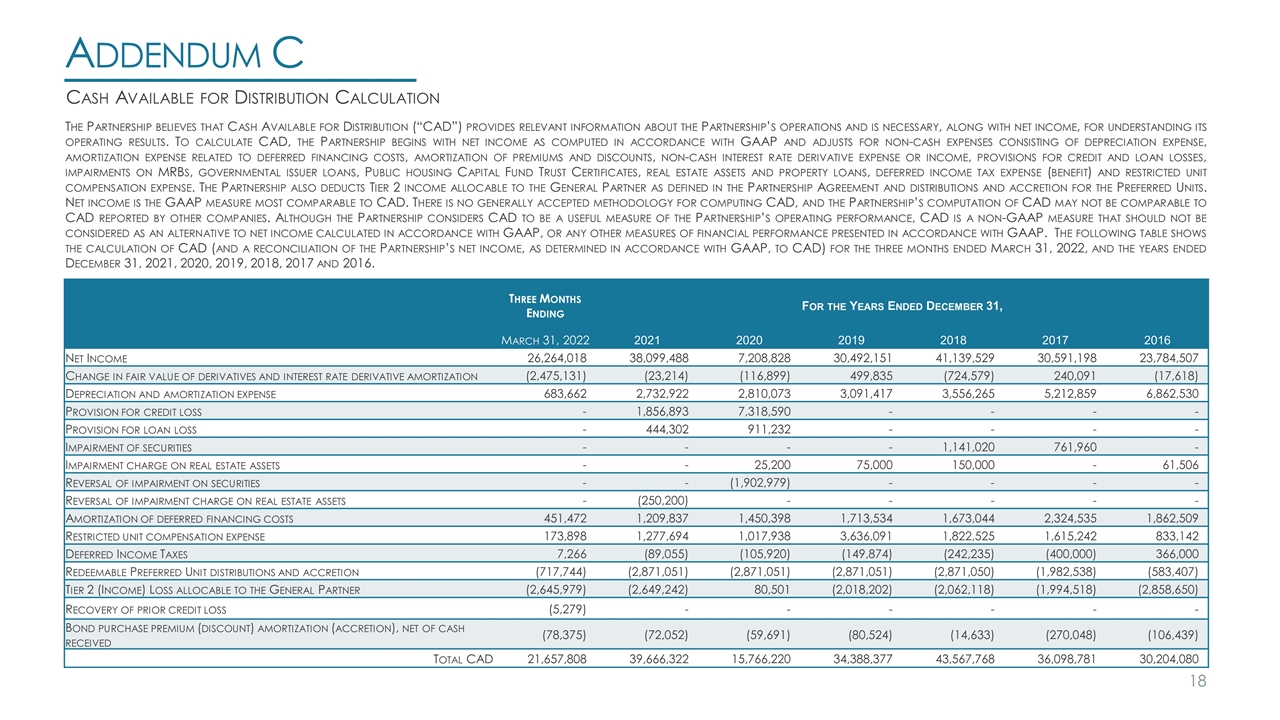

Addendum C Cash Available for Distribution Calculation The Partnership believes that Cash Available for Distribution (“CAD”) provides relevant information about the Partnership’s operations and is necessary, along with net income, for understanding its operating results. To calculate CAD, the Partnership begins with net income as computed in accordance with GAAP and adjusts for non-cash expenses consisting of depreciation expense, amortization expense related to deferred financing costs, amortization of premiums and discounts, non-cash interest rate derivative expense or income, provisions for credit and loan losses, impairments on MRBs, governmental issuer loans, Public housing Capital Fund Trust Certificates, real estate assets and property loans, deferred income tax expense (benefit) and restricted unit compensation expense. The Partnership also deducts Tier 2 income allocable to the General Partner as defined in the Partnership Agreement and distributions and accretion for the Preferred Units. Net income is the GAAP measure most comparable to CAD. There is no generally accepted methodology for computing CAD, and the Partnership’s computation of CAD may not be comparable to CAD reported by other companies. Although the Partnership considers CAD to be a useful measure of the Partnership’s operating performance, CAD is a non-GAAP measure that should not be considered as an alternative to net income calculated in accordance with GAAP, or any other measures of financial performance presented in accordance with GAAP. The following table shows the calculation of CAD (and a reconciliation of the Partnership’s net income, as determined in accordance with GAAP, to CAD) for the three months ended March 31, 2022, and the years ended December 31, 2021, 2020, 2019, 2018, 2017 and 2016. Three Months Ending For the Years Ended December 31, March 31, 2022 2021 2020 2019 2018 2017 2016 Net Income 26,264,018 38,099,488 7,208,828 30,492,151 41,139,529 30,591,198 23,784,507 Change in fair value of derivatives and interest rate derivative amortization (2,475,131) (23,214) (116,899) 499,835 (724,579) 240,091 (17,618) Depreciation and amortization expense 683,662 2,732,922 2,810,073 3,091,417 3,556,265 5,212,859 6,862,530 Provision for credit loss - 1,856,893 7,318,590 - - - - Provision for loan loss - 444,302 911,232 - - - - Impairment of securities - - - - 1,141,020 761,960 - Impairment charge on real estate assets - - 25,200 75,000 150,000 - 61,506 Reversal of impairment on securities - - (1,902,979) - - - - Reversal of impairment charge on real estate assets - (250,200) - - - - - Amortization of deferred financing costs 451,472 1,209,837 1,450,398 1,713,534 1,673,044 2,324,535 1,862,509 Restricted unit compensation expense 173,898 1,277,694 1,017,938 3,636,091 1,822,525 1,615,242 833,142 Deferred Income Taxes 7,266 (89,055) (105,920) (149,874) (242,235) (400,000) 366,000 Redeemable Preferred Unit distributions and accretion (717,744) (2,871,051) (2,871,051) (2,871,051) (2,871,050) (1,982,538) (583,407) Tier 2 (Income) Loss allocable to the General Partner (2,645,979) (2,649,242) 80,501 (2,018,202) (2,062,118) (1,994,518) (2,858,650) Recovery of prior credit loss (5,279) - - - - - - Bond purchase premium (discount) amortization (accretion), net of cash received (78,375) (72,052) (59,691) (80,524) (14,633) (270,048) (106,439) Total CAD 21,657,808 39,666,322 15,766,220 34,388,377 43,567,768 36,098,781 30,204,080