false0001059142DEF 14A0001059142ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001059142ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001059142ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-01-012024-12-310001059142ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2024-01-012024-12-310001059142ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001059142ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-3100010591422023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-31000105914232024-01-012024-12-310001059142ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2024-01-012024-12-310001059142ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001059142ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-3100010591422024-01-012024-12-310001059142ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001059142ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-31000105914212024-01-012024-12-310001059142ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310001059142ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-3100010591422022-01-012022-12-310001059142ecd:EqtyAwrdsAdjsMemberecd:PeoMember2022-01-012022-12-310001059142ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001059142ecd:EqtyAwrdsAdjsMemberecd:PeoMember2024-01-012024-12-310001059142ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2024-01-012024-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001059142ecd:EqtyAwrdsAdjsMemberecd:PeoMember2023-01-012023-12-310001059142ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001059142ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-01-012024-12-310001059142ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310001059142ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310001059142ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2024-01-012024-12-310001059142ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310001059142ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-31000105914222024-01-012024-12-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant

Filed by a party other than the Registrant

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under § 240.14a-12 |

|

Greystone Housing Impact Investors LP |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

|

|

|

☒ |

|

No fee required |

☐ |

|

Fee paid previously with preliminary materials |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

14301 FNB Parkway, Suite 211

Omaha, Nebraska 68154

(402) 952-1235

|

|

|

|

|

|

Notice of Consent Solicitation |

|

|

|

To the Beneficial Unit Certificate Holders of Greystone Housing Impact Investors LP:

We are pleased to send you and the other beneficial unit certificate holders (“BUC Holders”) of Greystone Housing Impact Investors LP (the “Partnership,” “we,” “us,” or “our”) these consent solicitation materials to solicit your consent for the sole purpose of approving and adopting an amendment to the Amended and Restated Greystone Housing Impact Investors LP 2015 Equity Incentive Plan (the “Incentive Plan”) to extend the term of the Incentive Plan to June 24, 2027.

We believe that equity compensation is important to assist the Partnership in attracting, retaining, and motivating our officers and the employees and managers of Greystone AF Manager LLC (“Greystone Manager”), which is the general partner of our general partner, America First Capital Associates Limited Partnership Two (the “General Partner”), who will contribute to our long-term success. We further believe that providing our officers and the employees and managers of Greystone Manager with a proprietary interest in the growth and performance of the Partnership aligns their interests with the interests of our BUC Holders and enhances BUC Holder value. Under the current terms of the Incentive Plan, the Incentive Plan will expire on June 24, 2025. Approval of the amendment will permit the Partnership to continue to make equity incentive awards to our officers, employees, and managers for an additional two years under the Incentive Plan, without requesting an increase in the number of BUCs authorized for issuance under the plan, in order to achieve the objectives described above. The Incentive Plan is described in more detail in the accompanying consent solicitation statement.

If the proposal to amend the Incentive Plan is approved by the BUC Holders, the amendment will become effective and incorporated into the Incentive Plan on the date of such approval.

Only BUC Holders of record as of the close of business on April 28, 2025 are entitled to receive notice of and to vote in the consent solicitation. The board of managers of Greystone Manager unanimously approved the Incentive Plan amendment proposal and determined that such proposal is in the best interests of the Partnership and its BUC Holders.

YOUR VOTE IS VERY IMPORTANT. The affirmative vote of the holders of a majority of the beneficial unit certificates representing assigned limited partnership interests in the Partnership (“BUCs”) issued and outstanding as of the close of business on the record date is required to approve the Incentive Plan amendment proposal. Failure to vote on the proposal will have the same effect as a vote against the proposal. Therefore, we encourage you to review the accompanying Consent Solicitation Statement and to vote as soon as possible. You may vote your BUCs by following the instructions provided in the Notice of Internet Availability of Consent Materials you received in the mail. If you received the consent solicitation materials by mail, you may either vote on the Internet at the website identified above, by telephone, or by completing, signing, dating, and returning the enclosed consent form by mail. If you hold your BUCs in “street name” with a bank, broker, or other nominee, and you wish to vote in the consent solicitation, you will need to follow the instructions provided by your bank, broker, or other nominee in order to vote your BUCs.

The consent solicitation will expire at, and your consent must be received by, 11:59 p.m. Eastern Daylight Time (EDT) on June 16, 2025 (the “Expiration Date”). The consent solicitation may be extended by Greystone Manager for a specified period of time or on a daily basis until the consents necessary to adopt the Incentive Plan amendment proposal have been received. You may revoke your consent at any time up to 11:59 p.m. EDT on the Expiration Date.

The board of managers of Greystone Manager, the general partner of the General Partner, recommends that BUC Holders vote “FOR” the approval of the Incentive Plan amendment proposal.

|

|

|

By Order of the Board of Managers of Greystone AF Manager LLC, the general partner of the General Partner of the Partnership,

Kenneth C. Rogozinski Chief Executive Officer of Greystone Housing Impact Investors LP |

Omaha, Nebraska |

|

April 30, 2025 |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

CONSENT SOLICITATION MATERIALS FOR THE CONSENT SOLICITATION

EXPIRING ON JUNE 16, 2025

The Notice of Consent Solicitation and the Consent Solicitation Statement for the

Consent Solicitation are available at https://www.astproxyportal.com/ast/26777.

TABLE OF CONTENTS

|

|

|

|

Page |

CONSENT SOLICITATION STATEMENT |

1 |

SUMMARY |

2 |

The Partnership |

2 |

Incentive Plan Amendment Proposal |

2 |

Interests of Certain Managers and Executive Officers in the Proposal |

3 |

Required Vote |

3 |

Recommendation of the Board of Managers |

3 |

Management Structure |

3 |

Additional Information |

4 |

DELIVERY OF CONSENT SOLICITATION MATERIALS |

5 |

QUESTIONS AND ANSWERS ABOUT THE CONSENT SOLICITATION |

5 |

CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING INFORMATION |

8 |

THE CONSENT SOLICITATION |

9 |

Purpose of the Consent Solicitation |

9 |

Recommendation of the Board of Managers |

9 |

Voting Securities, Record Date, and Outstanding BUCs |

10 |

Consent and Revocation of Consent |

10 |

Required Vote |

10 |

Solicitation of Consents |

10 |

No Appraisal Rights |

11 |

Householding Matters |

11 |

Notice to BUC Holders |

11 |

Voting Procedures |

11 |

Assistance |

12 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL HOLDERS AND MANAGEMENT |

13 |

APPROVAL OF THE INCENTIVE PLAN AMENDMENT PROPOSAL |

15 |

Why BUC Holders Should Approve the Amendment |

15 |

Description of the Incentive Plan |

17 |

Material United States Federal Income Tax Consequences |

19 |

Interests of Certain Managers and Executive Officers in the Incentive Plan Proposal |

21 |

New Plan Benefits |

21 |

Securities Authorized for Issuance Under Equity Compensation Plans |

21 |

Required Vote |

22 |

Board Recommendation |

22 |

EXECUTIVE COMPENSATION |

23 |

HOUSEHOLDING |

30 |

OTHER MATTERS |

30 |

WHERE YOU CAN FIND MORE INFORMATION |

30 |

APPENDICES |

|

A |

First Amendment to 2015 Equity Incentive Plan |

|

B |

Amended and Restated Greystone Housing Impact Investors LP 2015 Equity Incentive Plan |

|

14301 FNB Parkway, Suite 211

Omaha, Nebraska 68154

(402) 952-1235

|

|

|

|

|

|

Consent Solicitation Statement |

|

|

|

This Consent Solicitation Statement is being furnished to the beneficial unit certificate holders (“BUC Holders”) of Greystone Housing Impact Investors LP (the “Partnership,” “we,” “us,” or “our”) as of the close of business on April 28, 2025 (the “Record Date”) in connection with the solicitation of consents (the “Consent Solicitation”) of the BUC Holders for the sole purpose of approving and adopting an amendment to the Amended and Restated Greystone Housing Impact Investors LP 2015 Equity Incentive Plan (the “Incentive Plan”) to extend the term of the Incentive Plan to June 24, 2027.

This Consent Solicitation Statement and the accompanying form of Consent are first being made available to BUC Holders on or about April 30, 2025. Beginning on or about April 30, 2025, we mailed a Notice of Internet Availability of Consent Materials to our BUC Holders containing instructions on how to access this Consent Solicitation Statement and vote online. The notice also provides instructions on how to request a paper copy of these documents if you desire.

If the proposal to amend the Incentive Plan is approved by the BUC Holders, the amendment will become effective and incorporated into the Incentive Plan on the date of such approval. If the proposal is not approved by the BUC Holders, then the Incentive Plan will expire on June 24, 2025 and we will not be able to grant equity awards to the officers, employees, and managers who perform services for the Partnership after that date.

The accompanying consent is being solicited on behalf of the Board of Managers (the “Board”) of Greystone AF Manager LLC (“Greystone Manager”), which is the general partner of America First Capital Associates Limited Partnership Two (the “General Partner”), which is the general partner of the Partnership. Only BUC Holders of record as of the close of business on the Record Date are entitled to receive notice of and to vote in the Consent Solicitation. Adoption of the proposal to amend the Incentive Plan requires the affirmative vote of the holders of a majority of the beneficial unit certificates representing assigned limited partnership interests in the Partnership (“BUCs”) issued and outstanding as of the close of business on the Record Date.

The Board has unanimously approved the proposal to amend the Incentive Plan and determined that such proposal is in the best interests of the Partnership and its BUC Holders. The Board recommends that BUC Holders vote “FOR” the approval of the Incentive Plan amendment proposal. This Consent Solicitation will expire at, and your consent must be received by, 11:59 p.m. Eastern Daylight Time (EDT) on June 16, 2025 (the “Expiration Date”). Greystone Manager, on behalf of the Partnership, may extend this Consent Solicitation for a specified period of time or on a daily basis until the consents necessary to adopt the Incentive Plan amendment proposal have been received. You may revoke your consent at any time up to 11:59 p.m. EDT on the Expiration Date.

If you have any questions about this Consent Solicitation Statement, please call D.F. King & Co., Inc. at (888) 644-5854 or by sending an email to GHI@dfking.com. Alternatively, BUC Holders may call Jesse A. Coury, Chief Financial Officer of the Partnership, at (402) 952-1235. This Consent Solicitation Statement is dated April 30, 2025.

SUMMARY

The following summary highlights selected information in this Consent Solicitation Statement and may not contain all the information that may be important to you. Accordingly, we encourage you to carefully read this entire Consent Solicitation Statement, its appendices, and the documents referred to in this Consent Solicitation Statement before you decide how to vote. You may obtain the information referred to in this Consent Solicitation Statement without charge by following the instructions under “Where You Can Find More Information” beginning on page 30.

The Partnership

The Partnership was formed in 1998 for the primary purpose of acquiring a portfolio of mortgage revenue bonds (“MRBs”) that are issued by state and local housing authorities to provide construction and/or permanent financing for affordable multifamily housing, seniors housing and commercial properties. The Partnership also invests in governmental issuer loans (“GILs”), which are similar to MRBs, to provide construction financing for affordable multifamily properties. We expect and believe the interest received on our MRBs and GILs is excludable from gross income for federal income tax purposes. We also invest in other types of securities that may or may not be secured by real estate and may make property loans to multifamily properties which may or may not be financed by MRBs or GILs held by us and may or may not be secured by real estate. We expect that a majority of all assets held by us are and will continue to be considered eligible for regulatory credit under the Community Reinvestment Act of 1977.

The Partnership also makes noncontrolling equity investments in unconsolidated joint venture entities owned by the Partnership for the construction, stabilization, and ultimate sale of market-rate multifamily properties. The Partnership is entitled to distributions if, and when, cash is available for distribution either through operations, a refinance, or a sale of the property. In addition, the Partnership may acquire and hold interests in multifamily, student, or senior citizen residential properties until the “highest and best use” can be determined by management.

Our principal executive office is located at 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154, and our telephone number is (402) 952-1235. Our general partner is America First Capital Associates Limited Partnership Two, which is a subsidiary of Greystone AF Manager LLC. We maintain a website at www.ghiinvestors.com, where certain information about us is available. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this Consent Solicitation Statement or any other report or document we file with or furnish to the SEC.

Incentive Plan Amendment Proposal (page 15)

We are asking BUC Holders to approve and adopt an amendment to the Incentive Plan to extend the term of the Incentive Plan to June 24, 2027. This proposal is referred to in this document as the “Incentive Plan Amendment Proposal.” The purpose of the Incentive Plan is to promote the interests of the Partnership, Greystone Manager, and their affiliates by providing to employees and/or managers incentive compensation awards based on BUCs to encourage superior performance. The Incentive Plan also enhances the ability of the Partnership and its affiliates to attract and retain the services of individuals who are essential for the growth and profitability of the Partnership and its subsidiaries and to encourage them to devote their best efforts to advancing the business of the Partnership and its subsidiaries. In this regard, the Incentive Plan is designed to align directly the long-term compensation of the plan participants with the long-term interests of our BUC Holders.

Under the current terms of the Incentive Plan, the Incentive Plan will expire on June 24, 2025. Approval of the amendment will permit the Partnership to continue to make equity incentive awards to our officers, employees, and managers for an additional two years under the Incentive Plan, without requesting an increase in the number of BUCs authorized for issuance under the plan, in order to achieve the objectives described above.

The proposed First Amendment to the Incentive Plan (the “Amendment”), and the full text of the Incentive Plan, are attached as Appendix A and Appendix B, respectively, to this Consent Solicitation Statement and are

incorporated into this Consent Solicitation Statement by reference. You are encouraged to read the Amendment and the Incentive Plan in their entirety.

See “Approval of the Incentive Plan Amendment Proposal” beginning on page 15 for additional information.

Interests of Certain Managers and Executive Officers in the Proposal (page 21)

You should be aware that certain of the executive officers of the Partnership and the managers of Greystone Manager have interests in the Incentive Plan Amendment Proposal that may differ from, or may be in addition to, the interests of our BUC Holders generally. In particular, in considering the recommendation of the Board relating to the Incentive Plan Amendment Proposal, you should be aware that the officers and employees of the Partnership, the General Partner, the Partnership, their affiliates, and our subsidiaries, as well as the members of the Board, will continue to be eligible to receive awards under the Incentive Plan if the Amendment is approved by our BUC Holders. Accordingly, the members of the Board and the officers and employees of the Partnership, the General Partner, Greystone Manager, and their affiliates have a substantial interest in the approval of the Incentive Plan Amendment Proposal. These interests are more fully described in this Consent Solicitation Statement under the heading “Approval of the Incentive Plan Amendment Proposal – Interests of Certain Managers and Executive Officers in the Incentive Plan Amendment Proposal” beginning on page 21.

Required Vote (page 10)

Approval and adoption of the Incentive Plan Amendment Proposal requires the affirmative vote of the holders of a majority of the BUCs issued and outstanding as of the close of business on the Record Date. Abstentions and broker non-votes will have the same effect as a vote against the proposal.

Recommendation of the Board of Managers (page 9)

Based on the reasons discussed elsewhere in this Consent Solicitation Statement, the Board has determined that the approval and adoption of the Incentive Plan Amendment Proposal is in the best interests of the Partnership and its BUC Holders and recommends that the Partnership’s BUC Holders vote “FOR” the approval of the Incentive Plan Amendment Proposal. The Board has unanimously approved the Incentive Plan Amendment Proposal.

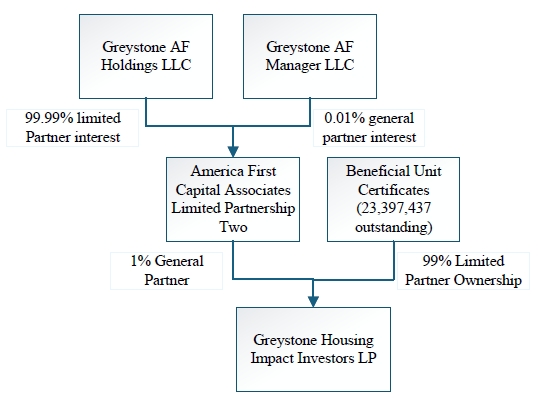

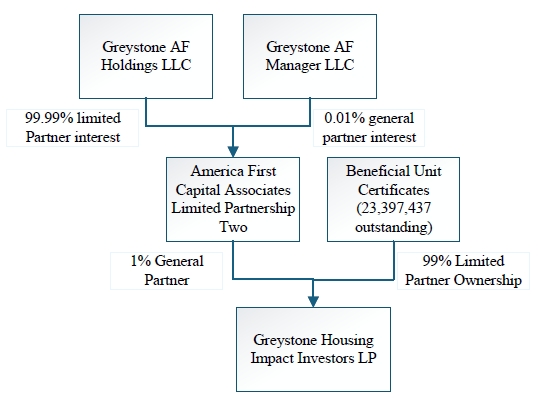

Management Structure

The Partnership is managed by the General Partner, which is managed by its general partner, Greystone Manager. The members of the Board of Greystone Manager act as the directors of the Partnership. The Partnership’s executive officers are Kenneth C. Rogozinski, the Chief Executive Officer, and Jesse A. Coury, the Chief Financial Officer. Mr. Rogozinski and Mr. Coury are employees, but not executive officers, of Greystone Manager. Under the terms of the Partnership’s Second Amended and Restated Agreement of Limited Partnership dated as of December 5, 2022, as further amended (the “Limited Partnership Agreement”), other than pursuant to awards under the Incentive Plan, the Partnership is not permitted to provide any compensation to executive officers of Greystone Manager, or to any limited partners of the General Partner. In this regard, the compensation of the executive officers of the Partnership is determined exclusively by Greystone Manager and the Partnership reimburses Greystone Manager for services provided by the Partnership’s executive officers. Accordingly, the Partnership does not have an executive compensation program for its executive officers that is controlled by the Partnership.

[Remainder of Page Intentionally Left Blank]

The chart below depicts our ownership structure and the relationships described in the previous paragraph, as of the date of this Consent Solicitation Statement:

Greystone Manager’s Board effectively acts as our board of directors. Although Greystone Manager is not a public company and its securities are not listed on any stock market or otherwise publicly traded, its Board is constituted in a manner that complies with the rules of the SEC and the New York Stock Exchange (“NYSE”) related to public companies with securities listed on that exchange in order for the Partnership and its BUCs to comply with these rules. Among other things, a majority of Greystone Manager’s Board consists of managers who meet the definitions of independence under the rules of the SEC and the NYSE. These independent managers are W. Kimball Griffith, Robert K. Jacobsen, Steven C. Lilly, and Deborah A. Wilson.

Additional Information (page 30)

You can find more information about the Partnership in the periodic reports and other information we file with the SEC. The information is available at the SEC’s public reference facilities and at the website maintained by the SEC at www.sec.gov. For a more detailed description of the additional information available, see “Where You Can Find More Information” beginning on page 30.

DELIVERY OF CONSENT SOLICITATION MATERIALS

On or about April 30, 2025, we mailed a Notice of Internet Availability of Consent Materials to our BUC Holders containing instructions on how to access the consent solicitation materials and vote online. We made these consent solicitation materials available to you over the Internet or, upon your request, have delivered paper versions of these materials to you by mail, in connection with the solicitation of consents by Greystone Manager’s Board for this consent solicitation.

At the time we begin mailing our Notice of Internet Availability of Consent Materials, we will also first make available on the Internet at https://www.astproxyportal.com/ast/26777, as well as on our website at http://www.ghiinvestors.com, the Notice of Consent Solicitation and Consent Solicitation Statement. Any BUC Holder may also request a printed copy of these materials, without charge, by sending an email to Jesse.Coury@greyco.com or by following the instructions included in the Notice of Internet Availability of Consent Materials.

QUESTIONS AND ANSWERS ABOUT THE CONSENT SOLICITATION

|

|

Q: |

What is the purpose of this Consent Solicitation Statement? |

|

|

A: |

We are asking BUC Holders to consider and consent to a proposal to approve and adopt an amendment to the Incentive Plan to extend the term of the Incentive Plan to June 24, 2027. Approval of the Incentive Plan Amendment Proposal will permit the Partnership to continue to make equity incentive awards to our officers, employees, and managers for an additional two years under the Incentive Plan, without requesting an increase in the number of BUCs authorized for issuance under the plan. This will continue to assist the Partnership in attracting, retaining, and motivating our officers and the employees and managers of Greystone Manager, which operates to align their interests with the interests of our BUC Holders to enhance BUC Holder value. Upon BUC Holder approval of the Incentive Plan Amendment Proposal, the amendment will become effective and incorporated into the Incentive Plan on the date of such approval. This Consent Solicitation Statement includes information that we are required to provide you under the rules of the SEC. |

|

|

Q: |

Who is entitled to vote? |

|

|

A: |

You will be entitled to vote on the Incentive Plan Amendment Proposal if you held BUCs of the Partnership as of the close of business on the Record Date, which is April 28, 2025. As of the Record Date, a total of 23,397,437 BUCs were issued and outstanding and entitled to vote in this Consent Solicitation. We expect that some of Greystone Manager’s employees may solicit BUC Holders personally, by mail, by telephone, or by other means, but none of these employees will receive any additional or special compensation for doing so. In addition, the Partnership has engaged D.F. King & Co., Inc. (“D.F. King”) to assist in soliciting consents and has agreed to pay them a fee for their services. |

|

|

Q: |

What vote is required? |

|

|

A: |

Approval and adoption of the Incentive Plan Amendment Proposal requires the affirmative vote of the holders of a majority of the BUCs issued and outstanding as of the close of business on the Record Date (the “Required Consent”). Abstentions and broker non-votes will have the same effect as a vote against the proposal. |

|

|

Q: |

What are broker non-votes? |

|

|

A: |

Generally, broker non-votes occur when BUCs held for a beneficial owner in “street name” (that is, by a broker, bank, or other nominee, which we refer to as your “broker”), are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner, and (2) the broker lacks discretionary voting power to vote those BUCs. Typically, a broker is entitled to vote BUCs held for a beneficial owner on routine matters without instructions from the beneficial owner of those BUCs. However, under the rules of the NYSE, the Incentive Plan Amendment Proposal is not considered a routine matter and brokers are not entitled to vote BUCs held for a beneficial owner on this matter without instructions from the beneficial owner of the BUCs. |

|

|

|

Because the proposal for the Consent Solicitation is non-routine and non-discretionary, broker non-votes will not occur with respect to the proposal in the event that a broker does not receive voting instructions for the proposal. In such an event, the BUCs will not be voted for the uninstructed proposal. If your BUCs are held in “street name,” your broker or other nominee will vote your BUCs on the proposal only if you provide instructions on how to vote on such proposal. If you fail to give any voting instructions to your broker with respect to any BUCs held in “street name,” those BUCs will not be voted in the Consent Solicitation. |

|

|

Q: |

If the proposal is approved, when will the Incentive Plan amendment become effective? |

|

|

A: |

If the Incentive Plan Amendment Proposal is approved by the BUC Holders, the amendment will become effective and incorporated into the Incentive Plan on the date of such approval, which we expect to be on the Expiration Date of the Consent Solicitation, or June 16, 2025. We will notify the BUC Holders of the results of this Consent Solicitation promptly after the Expiration Date. |

|

|

Q: |

What happens if the Incentive Plan Amendment Proposal is not approved? |

|

|

A: |

If the Incentive Plan Amendment Proposal is not approved, then the Incentive Plan will expire on June 24, 2025 and the Partnership will no longer be able to make equity incentive compensation awards to employees, officers, and managers of the Partnership and its affiliates after June 24, 2025. In that eventuality, the Partnership or Greystone Manager may be required to significantly increase the cash compensation of the employees and officers who perform services for the Partnership in order for us to remain competitive and to appropriately compensate our officers and the employees and managers of Greystone Manager. |

|

|

Q: |

Who pays for the costs of this Consent Solicitation? |

|

|

A: |

The Partnership will bear all the costs of this Consent Solicitation, including, but not limited to, the costs of preparing and mailing this Consent Solicitation Statement and the fees of approximately $35,800 for consent solicitation services. |

|

|

Q: |

When is the deadline to deliver my vote? |

|

|

A: |

The Consent Solicitation will expire at, and your consent must be received by the Expiration Date, which is 11:59 p.m. EDT on June 16, 2025. The Consent Solicitation may be extended by Greystone Manager, on behalf of the Partnership, for a specified period of time or on a daily basis until the consents necessary to approve the Incentive Plan Amendment Proposal have been received. You may revoke your consent at any time up to the Partnership’s receipt of the Required Consent. |

|

|

A: |

You may vote your BUCs on the Internet by following the instructions included in the Notice of Internet Availability of Consent Materials. Alternatively, if you received this Consent Solicitation Statement by mail, you may either vote on the Internet or by telephone at as described in the Notice of Internet Availability of Consent Materials that was sent to you, or by completing, signing, dating, and returning the enclosed consent card by mail. If you hold your BUCs in “street name” with a bank, broker, or other nominee, and you wish to vote in the Consent Solicitation, you will need to follow the instructions provided by your bank, broker, or other nominee in order to vote your BUCs. Because the affirmative vote of the holders of a majority of the BUCs issued and outstanding as of the close of business on the Record Date is required to approve the Incentive Plan Amendment Proposal, the failure to sign and return a consent form, abstaining with respect to the proposal, or the failure to otherwise vote in the Consent Solicitation will equate to a vote “Against” the proposal. Consent forms that are signed but not marked “For,” “Against,” or “Abstain” with respect to the proposal will be treated as consents in favor of the Incentive Plan Amendment Proposal. |

|

|

Q: |

May I revoke my consent? |

|

|

A: |

BUC Holders may revoke their consents at any time prior to 11:59 p.m. EDT on the Expiration Date (i) by dating, signing, and delivering to the Partnership a written notice that clearly expresses the revocation of consent, or (ii) by delivering a properly executed, subsequently dated consent form withholding a previously granted consent. Any such written notice or later dated consent form should be sent to the principal executive offices of the Partnership at 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154, Attention: Jesse A. |

|

|

|

Coury, Chief Financial Officer. Any revocation received after the Partnership’s receipt of the Required Consent will not be effective. |

|

|

Q: |

If my BUCs are held in “street name” by my broker, will my broker automatically vote my BUCs for me? |

|

|

A: |

If you hold your BUCs in street name with a broker, your broker will not be able to vote your BUCs without instructions from you on the Incentive Plan Amendment Proposal. You should follow the directions provided by your broker on how to vote your BUCs. |

|

|

Q: |

What do I need to do now? |

|

|

|

A: |

After reading this Consent Solicitation Statement, please mail your signed consent form in the enclosed return envelope or submit your vote by telephone or the Internet, as soon as possible, so your BUCs will be voted in the Consent Solicitation. To be sure that your vote is counted, please vote now. |

|

|

|

Q: |

Why is it important for me to vote? |

|

|

A: |

The Incentive Plan Amendment Proposal requires the affirmative vote of the holders of a majority of the BUCs issued and outstanding as of the close of business on the Record Date in order to be approved. Therefore, if you do not vote or fail to give instructions to your broker or bank to vote on your behalf with respect to the proposal, it will have the same effect as a vote “Against” the Incentive Plan Amendment Proposal. |

|

|

Q: |

How does the Greystone Manager Board of Managers recommend that I vote? |

|

|

A: |

The Board recommends that you vote “FOR” the approval of the Incentive Plan Amendment Proposal. The Board has unanimously approved the Incentive Plan Amendment Proposal. |

|

|

Q: |

Who do I contact if I have questions? |

|

|

A: |

Please direct all questions to Jesse A. Coury, Chief Financial Officer of the Partnership, 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154, Telephone: (402) 952-1235, Email: Jesse.Coury@greyco.com. |

|

|

Q: |

Where can I find more information about the Partnership? |

|

|

A: |

You can find more information about the Partnership from the various sources described under the heading “Where You Can Find More Information” beginning on page 30 of this Consent Solicitation Statement. |

Important Notice Regarding the Availability of Consent Solicitation Materials

You may obtain copies of our public filings, including this Consent Solicitation Statement, our 2024 Annual Report on Form 10-K, and the form of consent relating to the Consent Solicitation, without charge from our web site at http://www.ghiinvestors.com or from the SEC’s web site at http://www.sec.gov. You also may request a copy of these materials, without charge, by sending an email to Jesse.Coury@greyco.com. Please make your request no later than June 2, 2025 to facilitate timely delivery. If you do not request materials pursuant to the foregoing procedures, you will not otherwise receive an email or electronic copy of the materials.

CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING INFORMATION

This Consent Solicitation Statement contains forward-looking statements that have been made pursuant to the provisions of, and in reliance on the safe harbor under, the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Consent Solicitation Statement, including statements regarding our future results of operations and financial position, business strategy and plans, and objectives of management for future operations, are forward-looking statements. When used, statements which are not historical in nature, including those containing words such as “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are intended to identify forward-looking statements. We have based forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and results of operations. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties.

All written or oral forward-looking statements that are made by or attributable to the Partnership are expressly qualified in their entirety by this cautionary notice. The Partnership has no obligation and does not undertake to update, revise, or correct any of the forward-looking statements after the date of this Consent Solicitation Statement, or after the respective dates on which such statements otherwise are made. The Partnership does not make any assurances that its expectations, beliefs, or projections will be achieved or accomplished. These forward-looking statements are subject to various risks and uncertainties, including those relating to the following:

•defaults on the mortgage loans securing our MRBs and GILs;

•the competitive environment in which we operate;

•risks associated with investing in multifamily, student, senior citizen residential properties and commercial properties;

•general economic, geopolitical, and financial conditions, including the current and future impact of changing interest rates, inflation, and international conflicts (including the Russia-Ukraine war and the Israel-Hamas war) on business operations, employment, and financial conditions;

•uncertain conditions within the domestic and international macroeconomic environment, including trade policy, monetary and fiscal policy, and conditions in the investment, credit, interest rate, and derivatives markets;

•any effects on our business resulting from new U.S. domestic or foreign governmental trade measures, including but not limited to tariffs, import and export controls, foreign exchange intervention accomplished to offset the effects of trade policy or in response to currency volatility, and other restrictions on free trade;

•adverse reactions in U.S. financial markets related to actions of foreign central banks or the economic performance of foreign economies, including in particular China, Japan, the European Union, and the United Kingdom;

•the general condition of the real estate markets in the regions in which we operate, which may be unfavorably impacted by pressures in the commercial real estate sector, incrementally higher unemployment rates, persistent elevated inflation levels, and other factors;

•changes in interest rates and credit spreads, as well as the success of any hedging strategies we may undertake in relation to such changes, and the effect such changes may have on the relative spreads between the yield on our investments and our cost of financing;

•the aggregate effect of elevated inflation levels over the past several years, spurred by multiple factors including expansionary monetary and fiscal policy, higher commodity prices, a tight labor market, and low residential vacancy rates, which may result in continued elevated interest rate levels and increased market volatility;

•our ability to access debt and equity capital to finance our assets;

•current maturities of our financing arrangements and our ability to renew or refinance such financing arrangements;

•local, regional, national, and international economic and credit market conditions;

•recapture of previously issued LIHTCs in accordance with Section 42 of the IRC;

•geographic concentration of properties related to our investments; and

•changes in the U.S. corporate tax code and other government regulations affecting our business.

Additional factors that could cause the Partnership’s results to differ materially from those described in the forward-looking statements can be found in the Partnership’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

THE CONSENT SOLICITATION

We are furnishing this Consent Solicitation Statement to the Partnership’s BUC Holders as part of the solicitation of consents by the Board for use in connection with the Consent Solicitation.

Purpose of the Consent Solicitation

The Consent Solicitation is being conducted for the purpose of approving and adopting an amendment to the Incentive Plan to extend the term of the Incentive Plan to June 24, 2027. The purpose of the Incentive Plan is to promote the interests of the Partnership, Greystone Manager, and their affiliates by providing to employees and/or managers incentive compensation awards based on BUCs to encourage superior performance. The Incentive Plan also enhances the ability of the Partnership and its affiliates to attract and retain the services of individuals who are essential for the growth and profitability of the Partnership and its subsidiaries and to encourage them to devote their best efforts to advancing the business of the Partnership and its subsidiaries. In this regard, the Incentive Plan is designed to align directly the long-term compensation of the plan participants with the long-term interests of our BUC Holders. Under the current terms of the Incentive Plan, the Incentive Plan will expire on June 24, 2025. Approval of the amendment will permit the Partnership to continue to make equity incentive awards to our officers, employees, and managers for an additional two years under the Incentive Plan, without requesting an increase in the number of BUCs authorized for issuance under the plan, in order to achieve the objectives described above.

A copy of the proposed Amendment, and the full text of the Incentive Plan, are attached as Appendix A and Appendix B, respectively, to this Consent Solicitation Statement.

This document and the accompanying consent form are being made available to the Partnership’s BUC Holders on or about April 30, 2025.

Recommendation of the Board of Managers

Based on the reasons discussed elsewhere in this Consent Solicitation Statement, the Board has determined that the approval and adoption of the Incentive Plan Amendment Proposal is in the best interests of the Partnership and its BUC Holders and unanimously recommends that the BUC Holders vote “FOR” the approval of the Incentive Plan Amendment Proposal.

Voting Securities, Record Date, and Outstanding BUCs

This Consent Solicitation is being made subject to the conditions in this Consent Solicitation Statement and the accompanying form of consent. No meeting of the BUC Holders is contemplated to be held for the purpose of considering the Incentive Plan Amendment Proposal. Only record holders of the Partnership’s BUCs at the close of business on April 28, 2025 will be taken into account for the purpose of determining whether the requisite approval of the Incentive Plan Amendment Proposal has been obtained. Each BUC Holder entitled to vote is entitled to cast one vote for each BUC owned. For all intents and purposes, this includes BUC Holders who, under the Limited Partnership Agreement, are entitled to direct Greystone ILP, Inc., as the initial limited partner of the Partnership, to cast one vote for each BUC held (it being understood that the initial limited partner will act at the direction of the BUC Holders).

On the Record Date, there were a total of 23,397,437 BUCs outstanding, which were held by approximately 13,196 BUC Holders.

Consent and Revocation of Consent

The General Partner will accept forms of consent at any time before 11:59 p.m. EDT on the Expiration Date, which is June 16, 2025. The accompanying form of consent, when properly completed and returned, will constitute a BUC Holder’s consent, or the withholding of consent, to the approval of the Incentive Plan Amendment Proposal in accordance with the instructions contained therein. If a BUC Holder executes and returns a form of consent and does not specify otherwise, the BUCs represented by such form of consent will be voted “FOR” the approval of the Incentive Plan Amendment Proposal in accordance with the recommendation of the General Partner.

A BUC Holder who has executed and returned a form of consent may revoke it at any time before 11:59 p.m. EDT on the Expiration Date (i) by dating, signing, and delivering to the Partnership a written notice that clearly expresses the revocation of consent, or (ii) by delivering a properly executed, subsequently dated consent form withholding a previously granted consent. Any such written notice or later dated consent form should be sent to the principal executive offices of the Partnership at 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154, Attention: Jesse A. Coury, Chief Financial Officer. Any revocation received after the Partnership’s receipt of the Required Consent will not be effective.

If your BUCs are held in “street name” with a broker or other nominee, your broker or other nominee will vote your BUCs on the proposal only if you provide instructions on how to vote on such proposal. If you fail to give any voting instructions to your broker with respect to any BUCs held in “street name,” those BUCs will not be voted in the Consent Solicitation. Please follow the voting instructions sent to you by your broker or other nominee.

Required Vote

The approval and adoption of the Incentive Plan Amendment Proposal requires the affirmative vote of the holders of a majority of the BUCs issued and outstanding as of the close of business on the Record Date. A vote to “Abstain,” or a failure to vote your BUCs on the proposal will have the same effect as a vote “Against” the approval of the proposal. Broker non-votes will not occur with respect to the proposal.

The executive officers and managers of Greystone Manager, which is the general partner of the General Partner of the Partnership, owned in the aggregate 411,216 BUCs (constituting approximately 1.8% of the outstanding BUCs) as of the Record Date. Each executive officer and manager of Greystone Manager who holds BUCs has advised the General Partner that he or she intends to consent, as to the BUCs her or she owns, to the Incentive Plan Amendment Proposal. For further information concerning the ownership of BUCs by the executive officers and managers of Greystone Manager, see “Security Ownership of Certain Beneficial Holders and Management” beginning on page 13.

Solicitation of Consents

This Consent Solicitation is being made by the General Partner through the Board of Managers of Greystone Manager, the general partner of the General Partner of the Partnership. The costs of soliciting consents

will be borne by the Partnership. Consents will be solicited by mail, and may also be solicited personally, by telephone, facsimile transmission, e-mail, the Internet, or by other means by the managers, officers, and employees of Greystone Manager and its affiliates, with no special or extra compensation therefor, although such officers, managers, and employees may be reimbursed for out-of-pocket expenses incurred in connection with the solicitation. Arrangements also will be made with custodians, nominees, and fiduciaries for the forwarding of the Consent Solicitation materials to the beneficial owners of the Partnership’s BUCs held of record by such persons, and the Partnership may reimburse such custodians, nominees, and fiduciaries for reasonable out-of-pocket expenses that they incur in that regard.

To assist in the solicitation of consents, the Partnership has engaged D.F. King for a fee of approximately $23,800, plus reasonable out-of-pockets expenses.

Other than as discussed above, the Partnership has made no arrangements and has no understanding with any independent dealer, salesman, or other person regarding the solicitation of consents hereunder, and no person has been authorized by the Partnership to give any information or to make any representation in connection with the solicitation of consents for the approval of the Incentive Plan Amendment Proposal, other than those contained herein and, if given or made, such other information or representations must not be relied upon as having been authorized.

No Appraisal Rights

BUC Holders who object to the Incentive Plan Amendment Proposal and the resulting adoption of the Amendment will have no appraisal, dissenters’, or similar rights (i.e., the right to seek a judicial determination of the “fair value” of their BUCs and to compel the purchase of their BUCs for cash in that amount) under Delaware law or the Limited Partnership Agreement of the Partnership, nor will such rights be voluntarily accorded to BUC Holders by the Partnership. As a result, approval of the Incentive Plan Amendment Proposal by the holders of a majority in interest of the outstanding BUCs will be binding on all the BUC Holders.

Householding Matters

BUC Holders who share a single address will receive only one Notice of Internet Availability of Consent Materials and, if requested, one Consent Solicitation Statement at that address unless we have received instructions to the contrary from any BUC Holder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a BUC Holder of record residing at such an address wishes to receive a separate copy of this Consent Solicitation Statement or of future Consent Solicitation Statements (as applicable), he or she may contact D.F. King at (888) 644-5854 or GHI@dfking.com, or write to Jesse A. Coury, c/o Greystone Housing Impact Investors LP, 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154. We will deliver separate copies of this Consent Solicitation Statement promptly upon written or oral request. If you are a BUC Holder of record receiving multiple copies of our Consent Solicitation Statement, you can request householding by contacting us in the same manner. If you own your BUCs through a bank, broker, or other nominee, you can request additional copies of this Consent Solicitation Statement or request householding by contacting your broker, bank, or nominee.

Notice to BUC Holders

The General Partner will notify BUC Holders of the results of this Consent Solicitation promptly after the Expiration Date.

Voting Procedures

General

Ensure that your BUCs can be voted in the Consent Solicitation by submitting your consent form or contacting your broker, dealer, commercial bank, trust company, or other nominee.

If your BUCs are registered in the name of a broker, dealer, commercial bank, trust company, or other nominee, check the voting instructions forwarded by your broker, dealer, commercial bank, trust company, or other

nominee to see which voting options are available or contact your broker, dealer, commercial bank, trust company, or other nominee in order to obtain directions as to how to ensure that your BUCs are voted in the Consent Solicitation.

If your BUCs are registered in your name, submit your consent form as soon as possible by telephone, via the Internet, or, if you received a paper copy of the Consent Solicitation Statement, by signing, dating, and returning the consent form in the postage-paid envelope which accompanied the Consent Solicitation Statement, so that your BUCs can be voted in the Consent Solicitation. Instructions regarding telephone and Internet voting are included on the consent form.

The failure to vote on the Incentive Plan Amendment Proposal will have the same effect as a vote against the proposal. If you submit your consent form without indicating how you wish to vote, your consent form will be voted “FOR” approval of the Incentive Plan Amendment Proposal.

Electronic Voting

Our holders of record and many BUC Holders who hold their BUCs through a broker, dealer, commercial bank, trust company, or other nominee will have the option to submit their consent forms or voting instructions electronically by telephone or the Internet. Please note that there are separate arrangements for voting by telephone and Internet depending on whether your BUCs are registered in our records in your name or in the name of a broker, dealer, commercial bank, trust company, or other nominee. If you hold your BUCs through a broker, bank, or other nominee, you should check the voting instructions forwarded by your broker, dealer, commercial bank, trust company, or other nominee to see which options are available. Please read and follow the instructions on your consent form or voting instructions carefully.

Assistance

If you need assistance in completing your consent form or have questions regarding the Consent Solicitation, please contact Jesse A. Coury, Chief Financial Officer of the Partnership, 14301 FNB Parkway, Suite 211, Omaha, Nebraska 68154, (402) 952-1235, Email: Jesse.Coury@greyco.com.

Security Ownership of Certain Beneficial Holders and Management

As of April 28, 2025, the Record Date for the Consent Solicitation, the executive officers and managers of Greystone Manager beneficially owned, in the aggregate, 411,216 BUCs (or collectively approximately 1.8% of the outstanding BUCs). Each executive officer and manager of Greystone Manager who holds BUCs has advised the General Partner that he or she intends to consent, as to the BUCs he or she owns, to the Incentive Plan Amendment Proposal.

Certain members of Greystone Manager’s management and the Board have interests that may be different from, or in addition to, those of our BUC Holders generally. For more information, see “Approval of the Incentive Plan Amendment Proposal – Interests of Certain Managers and Executive Officers in the Incentive Plan Amendment Proposal” beginning on page 21.

The only executive officers of the Partnership are Kenneth C. Rogozinski, the Partnership’s Chief Executive Officer, and Jesse A. Coury, the Partnership’s Chief Financial Officer. The General Partner has no officers or employees. The other persons constituting the management of the Partnership are officers, employees, and managers of Greystone Manager. The following table and notes set forth information with respect to the beneficial ownership of the BUCs by Messrs. Rogozinski and Coury, by each of the managers of Greystone Manager, and by the managers of Greystone Manager and executive officers of the Partnership as a group. Unless otherwise indicated, the information below is current as of the Record Date and is based upon information furnished to us by such persons. Unless otherwise noted, all persons listed in the following table have sole voting and investment power over the BUCs they beneficially own and own such BUCs directly. For purposes of this table, the term “beneficial owner” means any person who, directly or indirectly, has the power to vote, or to direct the voting of, a BUC, or the power to dispose, or to direct the disposition of, a BUC, or has the right to acquire BUCs within 60 days of the Record Date. The percentages in the table below are based on 23,397,437 issued and outstanding BUCs as of the Record Date.

No person is known by the Partnership to beneficially own more than 5% of the BUCs. In addition, there are no arrangements known to the Partnership, the operation of which may at any subsequent date result in a change in control of the Partnership.

|

|

|

|

|

|

|

|

|

Name |

|

Number of

BUCs

Beneficially

Owned |

|

|

Percent of

Class |

|

Stephen Rosenberg, Chairman and Manager of Greystone Manager |

|

|

31,881 |

|

(1) |

* |

|

Kenneth C. Rogozinski, Chief Executive Officer |

|

|

189,553 |

|

(2) |

* |

|

Jesse A. Coury, Chief Financial Officer |

|

|

95,040 |

|

(3) |

* |

|

Jeffrey M. Baevsky, Manager of Greystone Manager |

|

|

15,247 |

|

(4) |

* |

|

Drew C. Fletcher, Manager of Greystone Manager |

|

|

13,235 |

|

(5) |

* |

|

Steven C. Lilly, Manager of Greystone Manager |

|

|

15,050 |

|

(6) |

* |

|

W. Kimball Griffith, Manager of Greystone Manager |

|

|

29,803 |

|

(7) |

* |

|

Deborah A. Wilson, Manager of Greystone Manager |

|

|

14,325 |

|

(8) |

* |

|

Robert K. Jacobsen, Manager of Greystone Manager |

|

|

7,082 |

|

(9) |

* |

|

All current executive officers and Managers of Greystone Manager as a group

(9 persons) |

|

|

411,216 |

|

|

|

1.8 |

% |

* Denotes ownership of less than 1%.

(1)Amount includes 14,709 BUCs held in Mr. Rosenberg’s retirement account. Amount includes 7,550 restricted units with respect to which Mr. Rosenberg has voting rights.

(2)Amount includes 61,164 BUCs held in Mr. Rogozinski’s retirement account. Amount includes 46,551 restricted units with respect to which Mr. Rogozinski has voting rights. Mr. Rogozinski and his spouse share voting and investment power of 81,834 BUCs reported above.

(3)Amount includes 38,736 restricted units with respect to which Mr. Coury has voting rights. Mr. Coury and his spouse share voting and investment power of 56,304 BUCs reported above.

(4)Amount includes 7,550 restricted units with respect to which Mr. Baevsky has voting rights.

(5)Amount includes 7,550 restricted units with respect to which Mr. Fletcher has voting rights.

(6)Amount includes 4,426 restricted units with respect to which Mr. Lilly has voting rights

(7)Amount includes 3,795 restricted units with respect to which Mr. Griffith has voting rights

(8)Amount includes 3,795 restricted units with respect to which Ms. Wilson has voting rights

(9)Amount includes 3,795 restricted units with respect to which Mr. Jacobsen has voting rights

[Remainder of Page Intentionally Left Blank]

APPROVAL OF THE INCENTIVE PLAN AMENDMENT PROPOSAL

We are seeking BUC Holder approval of the Amendment to the Incentive Plan to extend the term of the Incentive Plan by two years to June 24, 2027.

Our growth and future success depends on the efforts of our officers and the employees and managers of Greystone Manager. We believe that equity compensation is important to help the Partnership attract, retain, and motivate employees and managers who will contribute to our long-term success and to provide incentives that are linked directly to increases in the value of our BUCs, which will benefit all of our BUC Holders. We had 185,019 BUCs remaining for issuance under the Incentive Plan as of April 30, 2025. If our BUC Holders do not approve the Amendment, the Incentive Plan will expire on June 24, 2025 and we will only grant awards under the Incentive Plan until that date or, if sooner, until the BUCs available for issuance thereunder are exhausted. If our BUC Holders approve the Amendment, it will become effective on the date of such BUC Holder approval and we will be able to make equity incentive grants under the Incentive Plan for an additional two years. We are not requesting an increase in the number of BUCs available for issuance under the Incentive Plan.

The Greystone Manager Board has unanimously approved, and recommends that our BUC Holders approve, the Amendment.

The Amendment and the Incentive Plan are summarized below and the full text of the Amendment and the Incentive Plan are attached to this Consent Solicitation as Appendix A and Appendix B, respectively. Because this is a summary, it may not contain all the information that you may consider to be important. You should read Appendix A and Appendix B carefully before you decide how to vote on this proposal.

Why BUC Holders Should Approve the Amendment

Overview of Key Reasons to Approve the Amendment

•Equity incentive awards are an important element of the compensation paid to our executive officers.

•Absent approval of the Amendment, the Incentive Plan will expire on June 24, 2025 and the Partnership will no longer be able to grants equity incentive awards to its officers and the employees and managers of Greystone Manager.

•The Partnership has a history of prudent use of its BUCs available for issuance under the Incentive Plan and will continue to do so upon the extension of the Incentive Plan’s term.

•Failure to approve the Amendment will likely result in an increased reliance on cash compensation.

The Board has reviewed and approved the Amendment and recommends BUC Holders vote “FOR” the proposal.

Equity Incentive Awards are an Important Element of Executive Officer Compensation

•We believe that providing our executive officers with a proprietary interest in the growth and performance of the Partnership aligns their interests with the interests of our BUC Holders and enhances BUC Holder value.

•We also believe that a significant portion of an executive officer’s compensation should be directly linked to the Partnership’s performance. Consistent with this philosophy, a substantial portion of the total compensation of our CEO and CFO is provided in the form of long-term equity incentive awards.

We Use BUCs Prudently

As of December 31, 2024, 311,771 BUCs remained available for grant under the Incentive Plan. As of the date of this Consent Solicitation Statement, that number was further reduced by 126,752 BUCs subject to grants made after December 31, 2024 for annual awards to our executive officers and the managers of Greystone Manager. If the Incentive Plan Amendment Proposal is approved by our BUC Holders, this will allow the Partnership to continue to make new grants in the future in accordance with the terms of the Incentive Plan.

In determining to adopt the Amendment, the Board considered the following:

•No Additional BUC Reserve Request. We are not making any request for an increase in the number of BUCs available for issuance under the Incentive Plan. Therefore, if the Incentive Plan Amendment Proposal is approved by our BUC Holders, the remaining BUCs available for issuance under the Incentive Plan will continue to be 185,019.

•Burn Rate. The following table provides data on our annual BUCs usage under the Incentive Plan for the last three full fiscal years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

Restricted unit awards |

|

|

109,581 |

|

|

|

105,274 |

|

|

|

96,321 |

|

Restricted unit awards surrendered to pay tax withholding |

|

|

(19,757 |

) |

|

|

(28,714 |

) |

|

|

(23,880 |

) |

Forfeitures of restricted unit awards |

|

|

- |

|

|

|

- |

|

|

|

(5,437 |

) |

Net restricted unit awards |

|

|

89,824 |

|

|

|

76,560 |

|

|

|

67,004 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of BUCs outstanding, basic |

|

|

23,071,141 |

|

|

|

22,929,966 |

|

|

|

22,870,294 |

|

|

|

|

|

|

|

|

|

|

|

Burn rate (1) |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

0.4 |

% |

Burn rate, net (2) |

|

|

0.4 |

% |

|

|

0.3 |

% |

|

|

0.3 |

% |

(1)Burn rate is equal to restricted unit awards divided by weighted average number of BUCs outstanding, basic.

(2)Burn rate, net is equal to net restricted unit awards divided by weighted average number of BUCs outstanding, basic.

•Expected Duration of the Incentive Plan. The Amendment will become effective as of the date of its approval if approved by the BUC Holders (the “Amendment Effective Date”). Although the Incentive Plan will have a term of an additional two years from the Amendment Effective Date, we anticipate that based on our current grant practices the proposed BUCs reserve under the Incentive Plan will be sufficient to meet our needs for these additional two years. The actual duration of the Incentive Plan’s BUCs reserve will depend on many factors, including future grant date BUCs prices, participation rates, award sizes, award type mix and levels, future grant practices, competitive market practices, our hiring and promotion activity, acquisitions and divestitures, and the rate of returned BUCs due to forfeitures, the need to attract, retain and incentivize key talent, and the balance of total compensation between cash and equity-based awards.

•Dilution. Our equity plan dilution (or overhang rate) as of April 30, 2025 was 1.7%. Upon adoption of the Amendment, the Partnership expects its overhang (calculated on a fully diluted basis) to remain the same. We calculated our fully diluted overhang rate by dividing (1) the sum of the number of BUCs issuable pursuant to equity awards outstanding at the end of the calendar year plus BUCs remaining available for issuance for future awards, by (2) the sum of the number of BUCs outstanding at the end of the calendar year plus the sum of (1) above.

Failure to Approve Amendment Will Likely Result in Increased Cash Compensation

If the Amendment is not approved by our BUC Holders pursuant to this Consent Solicitation, we will not be able to grant equity incentive awards beyond June 24, 2025, which is the date the Incentive Plan is scheduled to

expire under its current terms. As such, we may be required to significantly increase the cash component of the compensation paid to our executive officers and the employees and managers of Greystone Manager in order to remain competitive and to appropriately compensate our executive officers and other employees. Replacing equity awards with cash awards may misalign the interests of our executive officers and other employees and managers with the interests of our BUC Holders.

Description of the Incentive Plan

The description of the Incentive Plan set forth below is a summary of the material features of the Plan. This summary, however, does not purport to be a complete description of all the provisions of the Incentive Plan. The summary is qualified in its entirety by reference to the Incentive Plan, a copy of which is attached hereto as Appendix B and incorporated herein by reference.

The purpose of the Incentive Plan is to promote the interests of the Partnership and its BUC Holders by providing incentive compensation awards that encourage superior performance. The Incentive Plan is also intended to enhance the ability of our General Partner to attract and retain the services of individuals who are essential for our growth and profitability and to encourage those individuals to devote their best efforts to advancing the Partnership’s business.

BUCs Subject to the Incentive Plan

The maximum number of BUCs that may be delivered with respect to awards under the Incentive Plan is 1,000,000 BUCs. As of April 30, 2025, the number of BUCs remaining available for issuance under the Incentive Plan is 185,019. The BUCs to be delivered under the Incentive Plan may be BUCs otherwise issuable by the Partnership, BUCs acquired in the open market, and/or BUCs acquired from any person. To the extent that an award terminates or is cancelled prior to and without the delivery of BUCs (or if an award is forfeited), the BUCs subject to the award may be used again with respect to new awards granted under the Incentive Plan.

Administration

The Incentive Plan is generally be administered by Greystone Manager’s Board, or any compensation committee of Greystone Manager’s Board, if appointed, or any other committee as may be appointed by the Board to administer the Plan (for purposes of this document, the Board or any such committee is referred to herein as the “Committee”). The Committee has the full authority, subject to the terms of the Incentive Plan, to establish, amend, suspend, or waive such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration of the Plan, to designate participants under the Plan, to determine the number of BUCs to be covered by awards, to determine the type or types of awards to be granted to a participant, and to determine the terms and conditions of any award.

Eligibility

All of Greystone Manager’s employees and members of the Board, and employees of Greystone Manager’s affiliates, including the Partnership, that perform services for Greystone Manager, the Partnership, or an affiliate of either are eligible to be selected to participate in the Incentive Plan. The selection of which eligible individuals will receive awards is within the sole discretion of the Committee.

Currently, 23 persons are eligible to participate in the Incentive Plan, including 16 employees of Greystone Manager, and the seven members of the Greystone Manager Board.

Term of Incentive Plan

The term of the Incentive Plan will expire on the earlier of (1) the date it is terminated by the Board; (2) the date BUCs are no longer available under the Plan for delivery pursuant to awards; or (3) June 24, 2025, which is the tenth anniversary of the Board’s approval of the Incentive Plan. If the Amendment is approved by our BUC Holders, the term of the Incentive Plan will be extended by two years so that it will expire on June 24, 2027.

Awards Under the Incentive Plan

BUC Options and BUC Appreciation Rights

BUC options (or “unit options,” as defined under the Incentive Plan) represent the right to purchase a number of BUCs at a specified exercise price. Unit appreciation rights represent the right to receive the appreciation in the value of a number of BUCs as of the exercise date over a specified exercise price, either in cash or in BUCs, as determined in the discretion of the Committee. Unit options and unit appreciation rights may be granted to such eligible individuals and with such terms as the Committee may determine, consistent with the terms of the Incentive Plan; however, the exercise price of a unit option or unit appreciation right generally must be equal to or greater than the fair market value of a BUC on the date of grant.

Restricted Units and Phantom Units

A restricted unit is a BUC that is subject to forfeiture while it remains unvested. Upon vesting, the forfeiture restrictions lapse and the participant holds a BUC that is not subject to forfeiture. A phantom unit is a notional BUC that entitles the participant to receive a BUC upon the vesting of the phantom unit (or on a deferred basis upon specified future dates or events) or, in the discretion of the Committee, cash equal to the fair market value of a BUC. The Committee may make grants of restricted and phantom units under the Incentive Plan that contain such terms, consistent with the Plan, as the Committee may determine are appropriate, including the period over which restricted or phantom units will vest. The Committee may, in its discretion, base vesting on the participant’s completion of a period of service or upon the achievement of specified performance criteria or as otherwise set forth in an award agreement. Distributions made by us with respect to awards of restricted units may be subject to the same vesting requirements as the restricted units. The Committee, in its discretion, may also grant tandem distribution equivalent rights with respect to phantom units.

Unit Awards

A unit award is an award of BUCs that are fully vested upon grant and are not subject to forfeiture. Unit awards may be paid in addition to, or in lieu of, cash or other compensation that would otherwise be payable to a participant. A unit award may be wholly discretionary in amount or it may be paid with respect to a bonus or other incentive compensation award, the amount of which is determined based on the achievement of performance criteria or other factors.

Other Unit-Based Awards

The Incentive Plan also permits the grant of “other unit-based awards,” which are awards that, in whole or in part, are valued or based on or related to the value of a BUC. The vesting of an other unit-based award may be based on a participant’s continued service, the achievement of specified performance criteria, or other measures. On vesting (or on a deferred basis upon specified future dates or events), an other unit-based award may be paid in cash and/or in BUCs, as determined by the Committee.

Adjustments

Upon the occurrence of any distribution (whether in cash, BUCs, other securities, or other property), recapitalization, BUCs split, reorganization or liquidation, merger, consolidation, split-up, spin-off, separation, combination, repurchase, acquisition of property or securities, or exchange of BUCs or other securities of the Partnership, issuance of warrants or other rights to purchase BUCs or other securities of the Partnership, or other similar transaction or event affects the BUCs, then the Committee will equitably adjust any or all of (i) the number and type of BUCs (or other securities or property) with respect to which awards may be granted, (ii) the number and type of BUCs (or other securities or property) subject to outstanding awards, (iii) the grant or exercise price with respect to any award, (iv) any performance criteria for performance-based awards, except for awards based on continued service as an employee or manager, (v) the appropriate fair market value and other price determinations for such awards, and (vi) any other limitations in the Incentive Plan or, subject to Section 409A of the Internal

Revenue Code of 1986, as amended (the “Code”), make provision for a cash payment to the holder of an outstanding award. Notwithstanding any adjustment described above, the number of BUCs subject to an award will always be a whole number.

Miscellaneous

The Board may amend or modify the Incentive Plan at any time; provided, however, that BUC Holder approval will be obtained for any amendment to the Incentive Plan to the extent necessary to comply with any applicable law, regulation, or securities exchange rule. The Committee may also amend any award agreement evidencing an award made under the Incentive Plan, provided that no change in any outstanding award may be made that would adversely affect the rights of the participant under any previously granted award without the consent of the affected participant.

Repricing of unit options and unit appreciation rights, directly or indirectly, is prohibited under the Incentive Plan without the approval of our BUC Holders, except in the case of adjustments implemented to reflect certain Partnership transactions, as described above.

Material United States Federal Income Tax Consequences

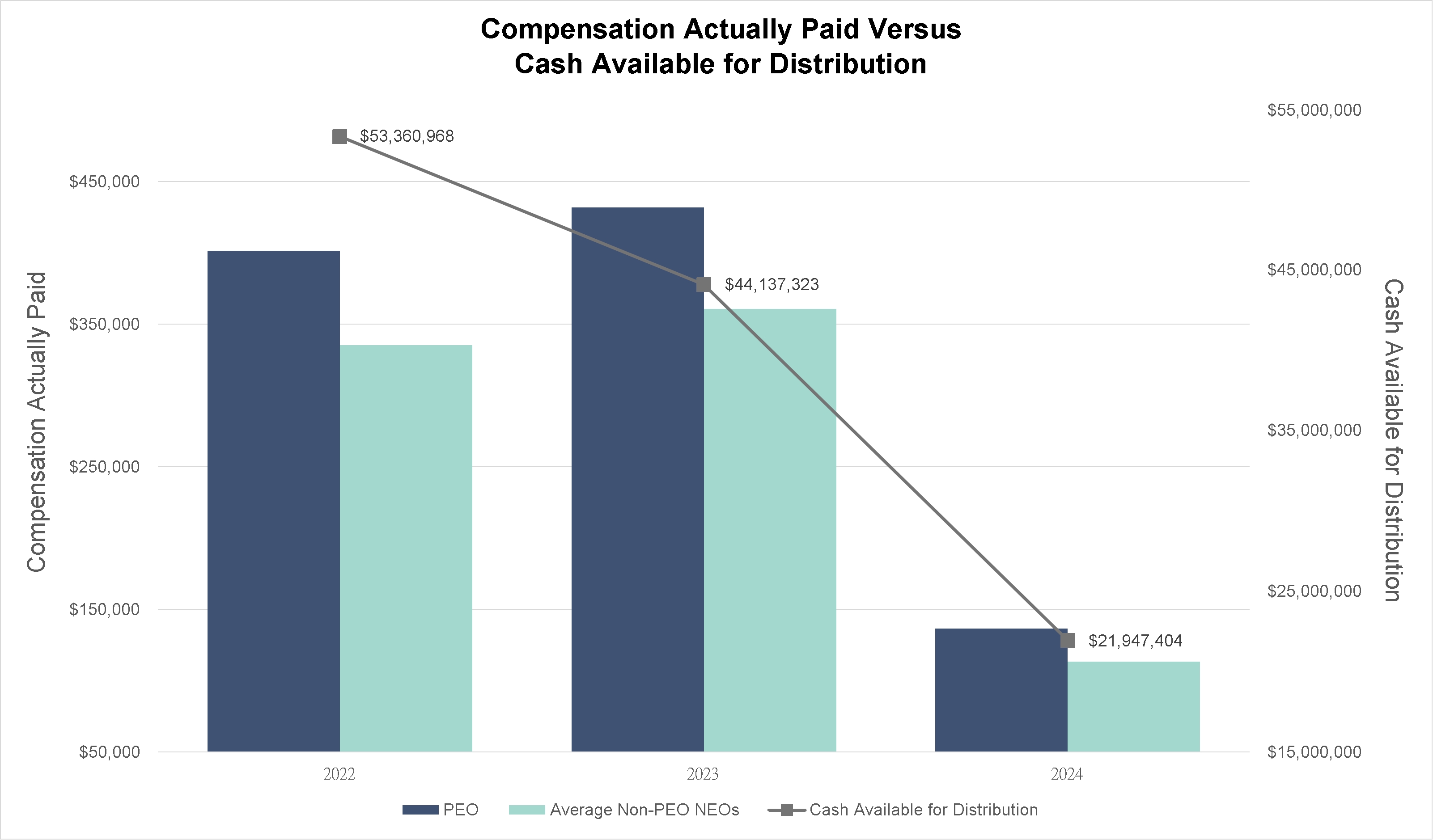

The following discussion is for general information only and is intended to summarize briefly the material United States federal tax consequences to participants arising from participation in the Incentive Plan. This description is based on existing U.S. laws and regulations, and there can be no assurance that those laws and regulations will not change in the future. This discussion is not intended as tax guidance to participants in the Incentive Plan, as the tax treatment of participants in the Incentive Plan may vary with the types of awards made, the identity of the recipients, and the method of payment or settlement. No attempt has been made to discuss any potential foreign, state, or local tax consequences. Moreover, this summary does not address the tax consequences upon a participant’s death, or the effects of other federal taxes (including possible “golden parachute” excise taxes). In addition, unit options or unit appreciation rights that provide for a “deferral of compensation” within the meaning of Section 409A of the Code, phantom units, and certain other awards that may be granted pursuant to the Incentive Plan could be subject to additional taxes unless they are designed to comply with certain restrictions set forth in Section 409A and the guidance promulgated thereunder.