Exhibit 99.1

Supplemental Financial Report for the

Quarter Ended September 30, 2023

©2023 Greystone & Co. II LLC. All rights reserved. References to the term “Greystone,” refer to Greystone & Co. II LLC and/or its affiliated companies, as applicable. |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Partnership Financial Information

TABLE OF CONTENTS

Letter from the CEO |

3 |

Quarterly Fact Sheet |

5 |

Financial Performance Information |

6 |

Appendices |

18 |

Important Disclosure Notices |

22 |

Other Partnership Information |

24 |

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Letter from the CEO

I am pleased to report Greystone Housing Impact Investors LP’s operating results for the third quarter of 2023. We reported the following financial results as of and for the three months ended September 30, 2023:

We reported the following notable transactions during the third quarter of 2023:

We continue to strategically invest in the affordable multifamily MRB and GIL asset classes where we believe we can earn attractive leveraged returns. We also continue to see consistent operating results from the properties underlying our affordable multifamily MRBs and GILs, with all such investments being current on contractual principal and interest payments as of September 30, 2023.

Other highlights of our investment portfolio include the following:

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

In November 2023, we completed a new secured financing transaction (the “TEBS Residual Financing”) secured by our residual interests in three Freddie Mac Tax Exempt Bond Securitization financings (“TEBS Financings”). The transaction involved the sale of the TEBS Financings residual interests to a governmental entity, which then issued and sold $61.5 million of senior Affordable Housing Multifamily Certificates to unaffiliated investors. We retained $20.5 million of residual Affordable Housing Multifamily Certificates as part of the transaction. We received net proceeds of approximately $60.4 million after payment of transaction-related costs. The $61.5 million of senior Affordable Housing Multifamily Certificates represent secured financing of the Partnership for financial reporting purposes. The senior Affordable Housing Multifamily Certificate holders are entitled to interest at a fixed rate of 7.125% per annum as well as certain principal payments from the assets within the TEBS Residual Financing. The TEBS Residual Financing has a maximum term ending in July 2034. The Partnership used $57.9 million of the net proceeds to pay down existing variable-rate corporate debt with a higher interest rate and a shorter maturity.

The closing of the TEBS Residual Financing provides many benefits to the Partnership. This new debt financing provides non-recourse, non-mark-to-market financing that generates effective interest cost savings of approximately 3.9% per annum compared to our prior variable-rate corporate debt which was secured by the same collateral. We have also successfully extended the term of the financing by approximately nine years.

We have noticed traditional bank lenders are offering less credit or imposing more restrictive terms on borrowers, creating new opportunities for us to pursue beyond our traditional pipeline. We will continue to strategically work with strong sponsors on new investment opportunities where traditional sources of capital may not currently be available. We will also continue to seek to develop new relationships, particularly with those sponsors that are existing clients of Greystone and its affiliates.

Thank you for your continued support of Greystone Housing Impact Investors LP!

Kenneth C. Rogozinski

Chief Executive Officer

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Third Quarter 2023 Fact Sheet

PARTNERSHIP DETAILS |

|

Greystone Housing Impact Investors LP was formed for the primary purpose of acquiring a portfolio of MRBs that are issued to provide construction and/or permanent financing of affordable multifamily residential and commercial properties. We also invest in GILs, which are similar to MRBs, to provide construction financing for affordable multifamily properties. We expect and believe the interest paid on the MRBs and GILs to be excludable from gross income for federal income tax purposes. In addition, we have invested in equity interests in multifamily, market rate properties throughout the U.S. We also own interests in multifamily properties (“MF Properties”) until the “highest and best use” can be determined. We continue to pursue a business strategy of acquiring additional MRBs and GILs on a leveraged basis, and other investments.

|

||||

(As of September 30, 2023) |

|

|||||

|

|

|||||

Symbol (NYSE) |

|

|

GHI |

|

||

Most Recent Quarterly Distribution per BUC (1) |

$ |

0.44 |

|

|||

|

|

|

|

|||

BUC Price |

$ |

15.45 |

|

|||

Year to Date Annualized Yield (2) |

|

10.8% |

|

|||

|

|

|

|

|

||

BUCs Outstanding |

|

|

22,734,375 |

|

||

Market Capitalization |

|

$ |

$351,246,094 |

|

||

52-week BUC price range |

|

$15.07 to $19.28 |

|

|||

|

|

|

|

|

||

|

|

|

|

|

||

Partnership Financial Information for Q3 2023 ($’s in 000’s, except per BUC amounts) |

|

|||||

|

9/30/2023 |

|

12/31/2022 |

|

||

|

|

|

|

|

||

Total Assets |

$1,546,331 |

|

$1,567,130 |

|

||

Leverage Ratio (3) |

72% |

|

73% |

|

||

|

|

|

|

|

||

|

Q3 2023 |

|

YTD 2023 |

|

||

|

|

|

|

|

||

Total Revenue |

$26,474 |

|

$79,716 |

|

||

Net Income |

$9,729 |

|

$47,808 |

|

||

Cash Available for Distribution (“CAD”) (4) |

$5,602 |

|

$37,953 |

|

||

Cash Distributions declared, per BUC (1) |

$0.368 |

|

$1.102 |

|

||

BUCs Distributions declared, per BUC (1) |

$0.070 |

|

$0.139 |

|

||

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Operating Results Summary

(Dollar amounts in thousands, except per BUC information)

|

|

Q3 2022 |

|

|

Q4 2022 |

|

|

Q1 2023 |

|

|

Q2 2023 |

|

|

Q3 2023 |

|

|||||

Total revenues |

|

$ |

22,604 |

|

|

$ |

22,030 |

|

|

$ |

24,938 |

|

|

$ |

28,304 |

|

|

$ |

26,474 |

|

Total expenses |

|

|

(14,750 |

) |

|

|

(19,002 |

) |

|

|

(23,506 |

) |

|

|

(14,344 |

) |

|

|

(16,771 |

) |

Gain on sale of investments in unconsolidated entities |

|

|

10,581 |

|

|

|

141 |

|

|

|

15,367 |

|

|

|

7,326 |

|

|

|

32 |

|

Income tax (expense) benefit |

|

|

82 |

|

|

|

6 |

|

|

|

(7 |

) |

|

|

1 |

|

|

|

(6 |

) |

Net income |

|

$ |

18,517 |

|

|

$ |

3,175 |

|

|

$ |

16,792 |

|

|

$ |

21,287 |

|

|

$ |

9,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Per BUC operating metrics(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income |

|

$ |

0.79 |

|

|

$ |

0.09 |

|

|

$ |

0.60 |

|

|

$ |

0.85 |

|

|

$ |

0.39 |

|

Cash available for distribution |

|

$ |

0.53 |

|

|

$ |

0.15 |

|

|

$ |

0.81 |

|

|

$ |

0.62 |

|

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Per BUC distribution information(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Cash distributions declared |

|

$ |

0.37 |

|

|

$ |

0.47 |

|

|

$ |

0.37 |

|

|

$ |

0.37 |

|

|

$ |

0.37 |

|

BUC distributions declared |

|

|

0.20 |

|

|

|

0.20 |

|

|

|

- |

|

|

|

0.07 |

|

|

|

0.07 |

|

Total distributions declared |

|

$ |

0.57 |

|

|

$ |

0.67 |

|

|

$ |

0.37 |

|

|

$ |

0.44 |

|

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Weighted average BUCs outstanding |

|

|

22,247,781 |

|

|

|

22,501,386 |

|

|

|

22,538,928 |

|

|

|

22,639,852 |

|

|

|

22,734,412 |

|

BUCs outstanding, end of period |

|

|

22,247,781 |

|

|

|

22,539,029 |

|

|

|

22,538,878 |

|

|

|

22,639,852 |

|

|

|

22,734,375 |

|

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

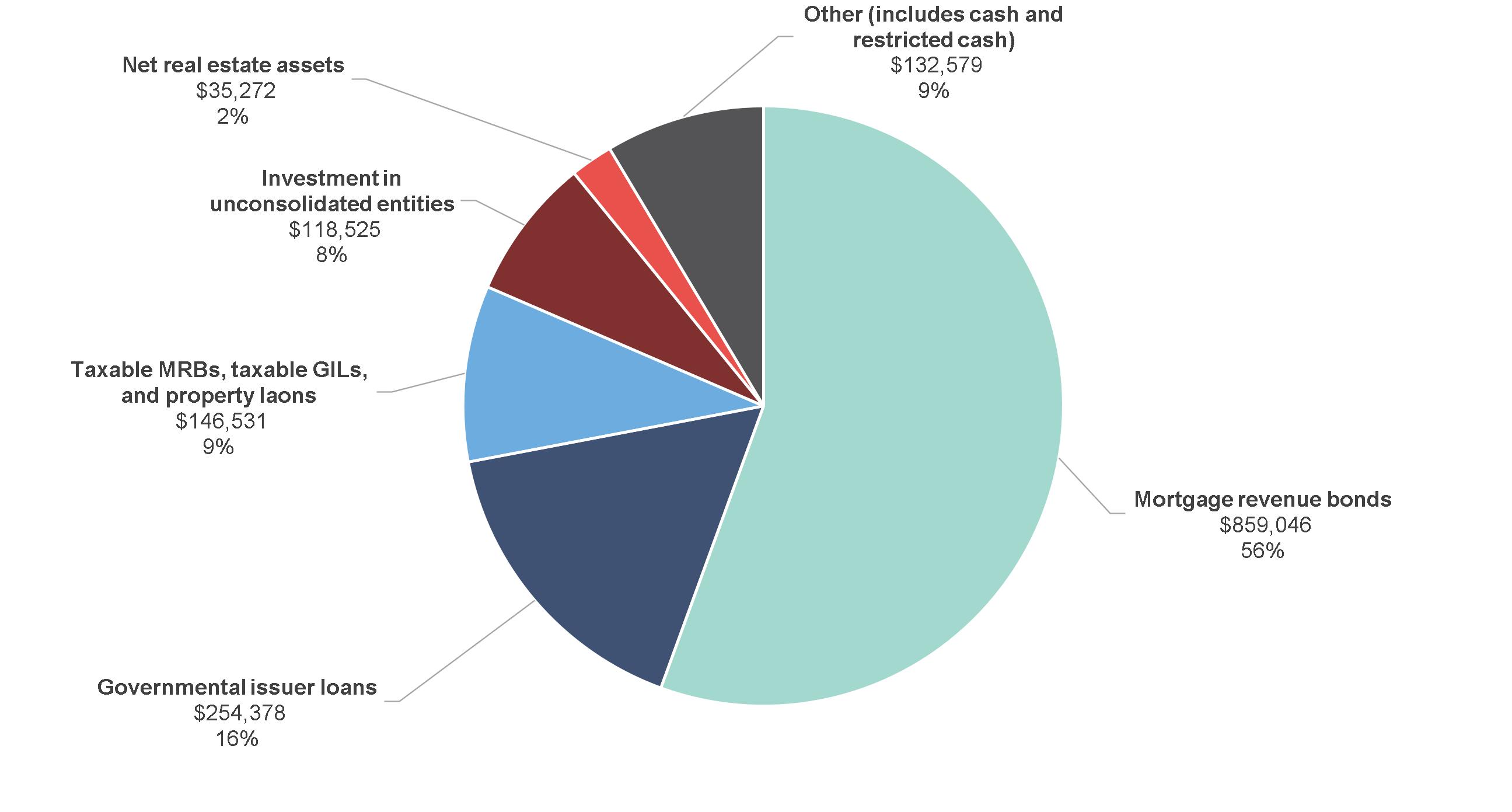

Asset Profile

(Dollar amounts in thousands)

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

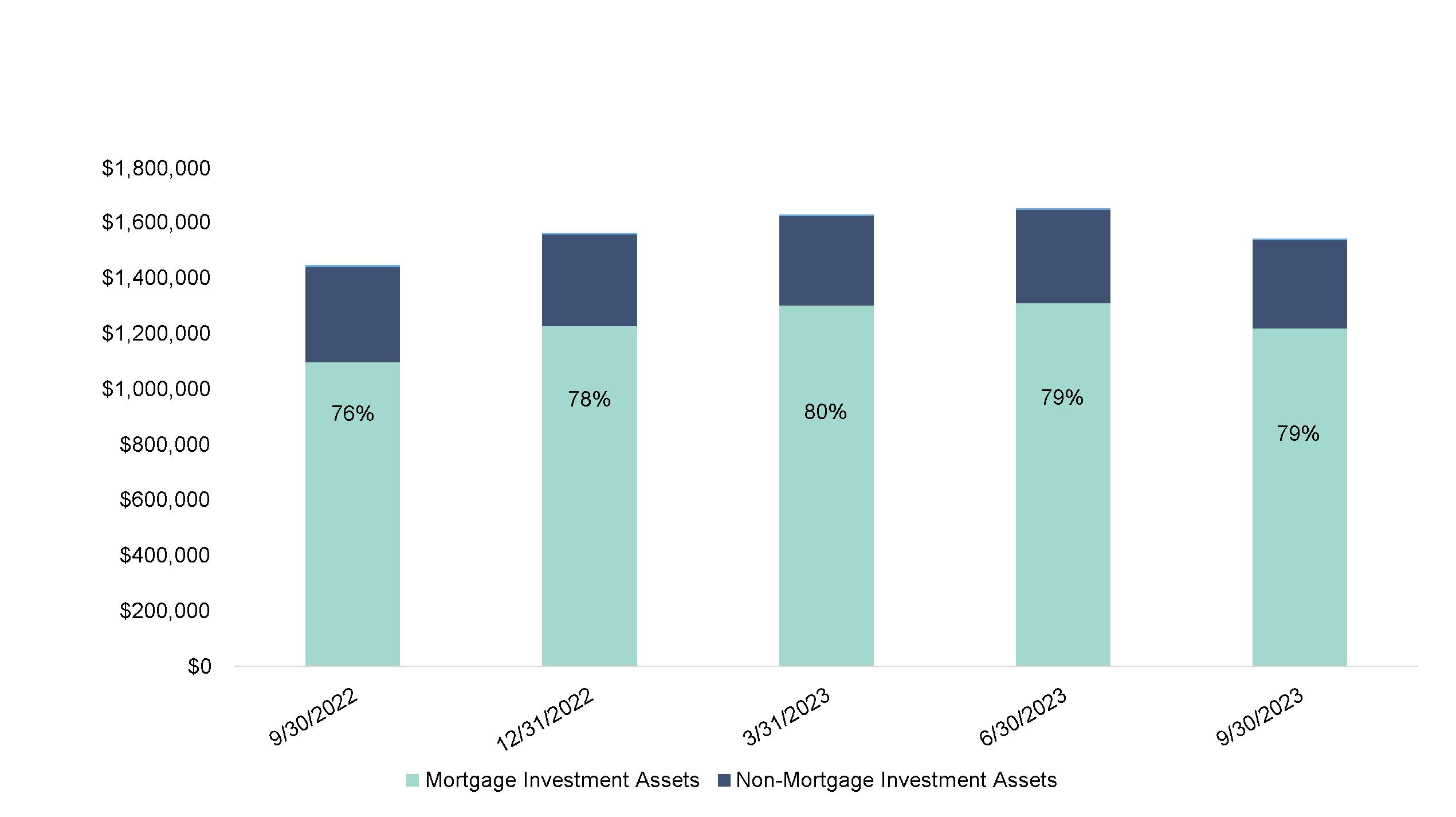

Mortgage Investments to Total Assets Profile

(Dollar amounts in thousands)

Note: Mortgage Investments include the Partnership’s Mortgage Revenue Bonds, Governmental Issuer Loans, Taxable Mortgage Revenue

Bonds, Taxable Governmental Issuer Loans, and Property Loans that share a first mortgage lien with the Governmental Issuer Loans.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

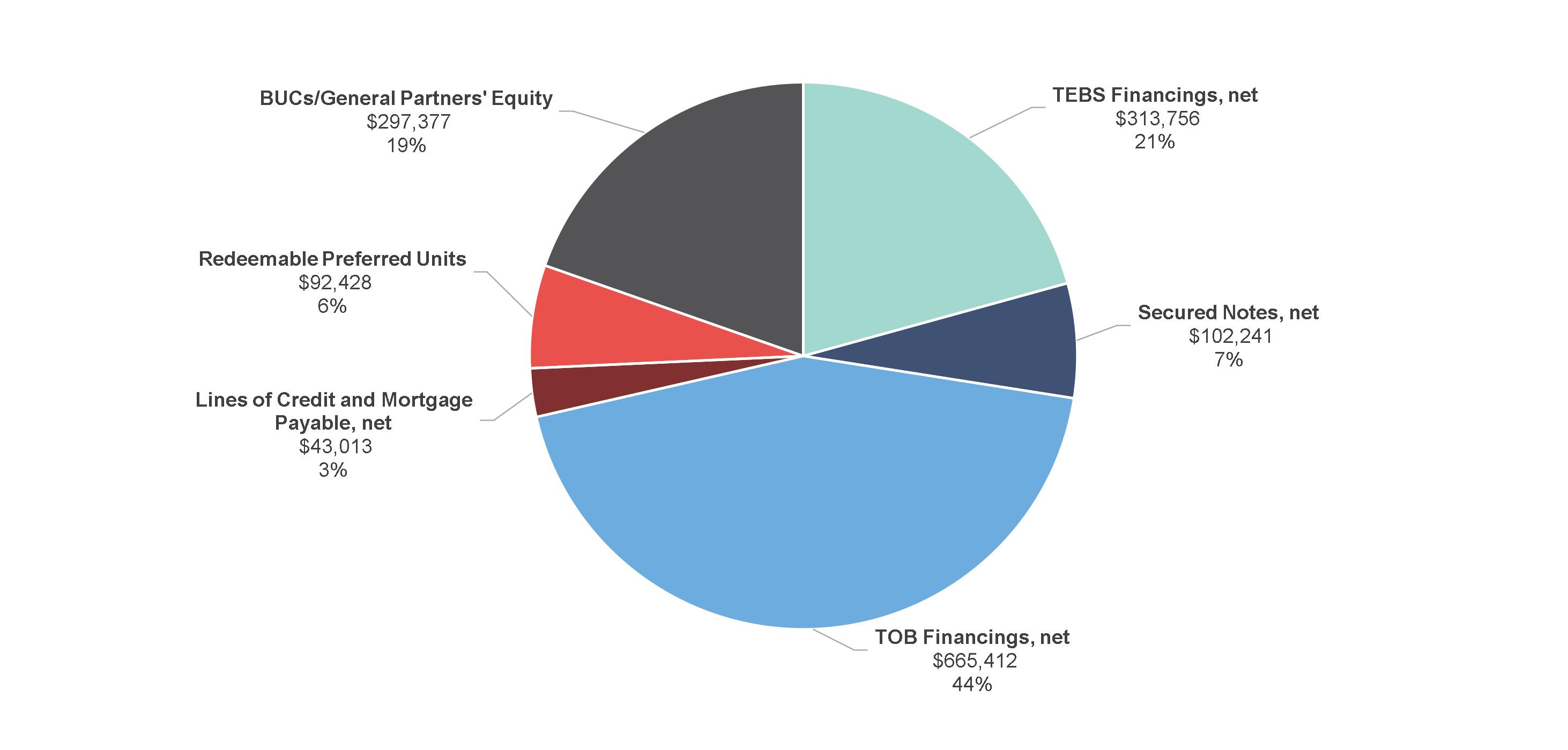

Debt and Equity Profile

(Dollar amounts in thousands)

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

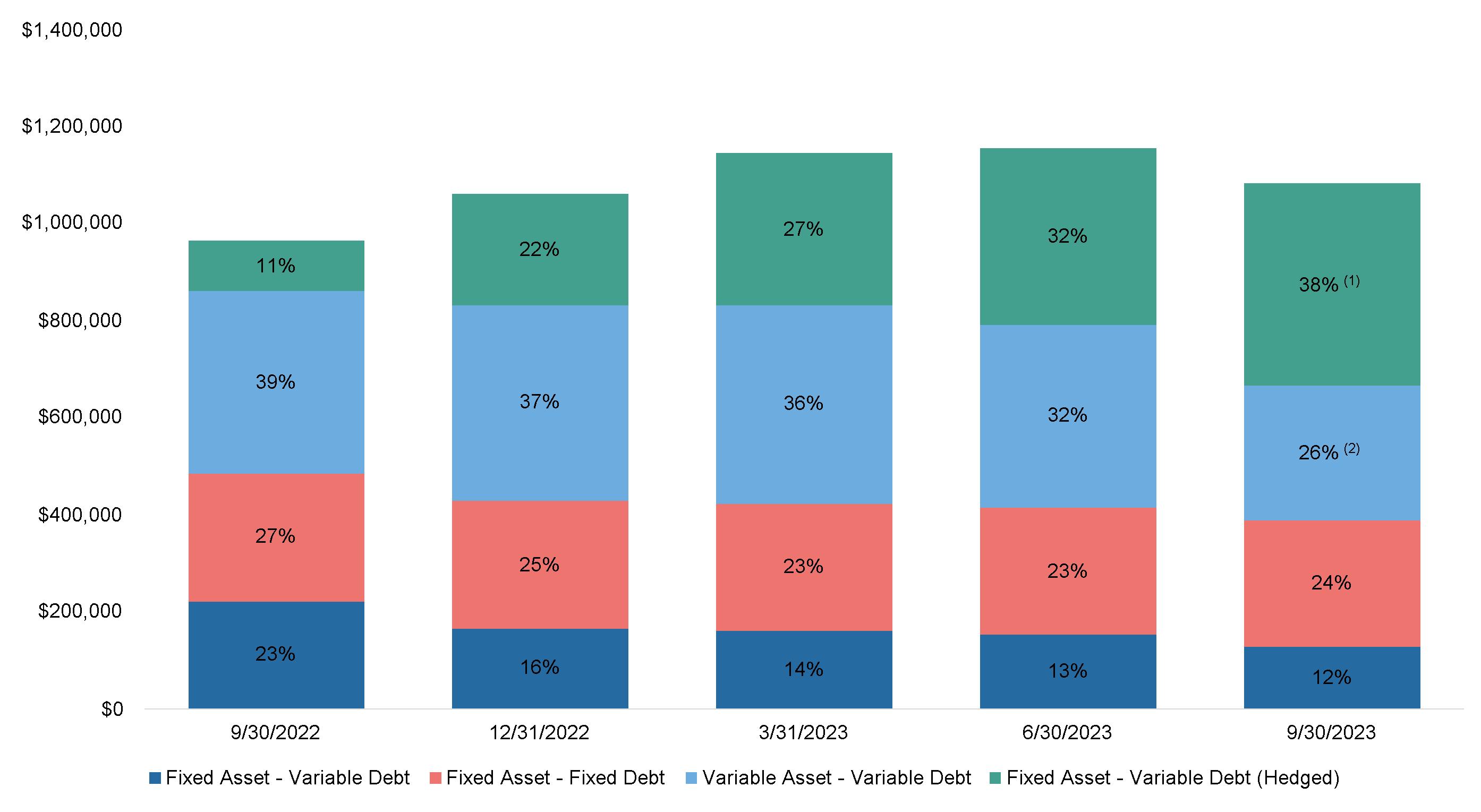

Debt Financing

(Dollar amounts in thousands)

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

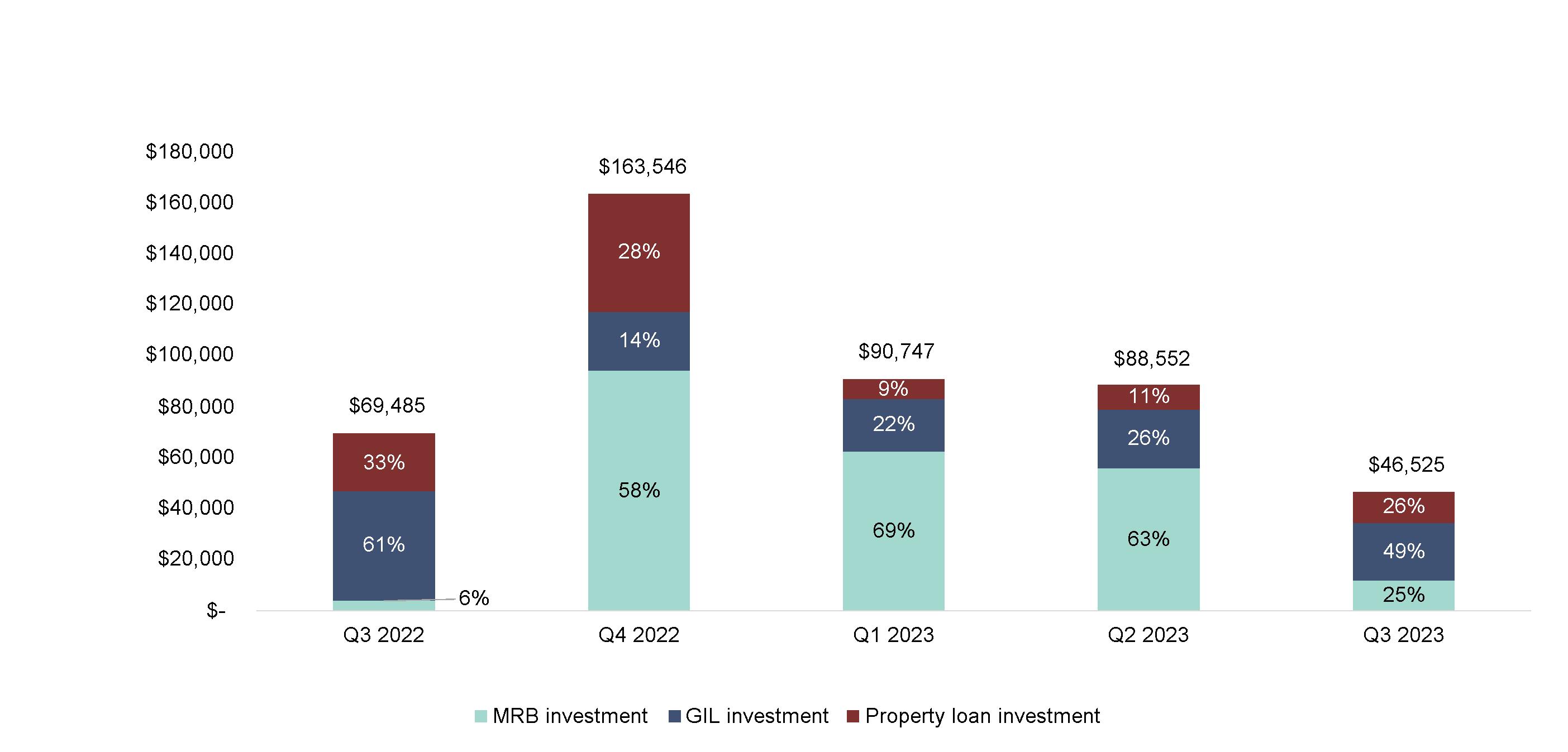

Debt Investments Activity

(Dollar amounts in thousands)

Quarterly Activity |

Q3 2022 |

|

Q4 2022 |

|

Q1 2023 |

|

Q2 2023 |

|

Q3 2023 |

|

|||||

Investment Purchases |

$ |

69,485 |

|

$ |

163,546 |

|

$ |

90,747 |

|

$ |

88,552 |

|

$ |

46,525 |

|

Sales and Redemptions |

|

(40,109 |

) |

|

(7,779 |

) |

|

(31,622 |

) |

|

(65,511 |

) |

|

(126,121 |

) |

Net Investment Activity |

|

29,376 |

|

|

155,767 |

|

|

59,125 |

|

|

23,041 |

|

|

(79,596 |

) |

Net Debt Proceeds |

|

(21,832 |

) |

|

(120,394 |

) |

|

(35,595 |

) |

|

(16,330 |

) |

|

68,749 |

|

Net Capital Deployed |

$ |

7,544 |

|

$ |

35,373 |

|

$ |

23,530 |

|

$ |

6,711 |

|

$ |

(10,847 |

) |

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

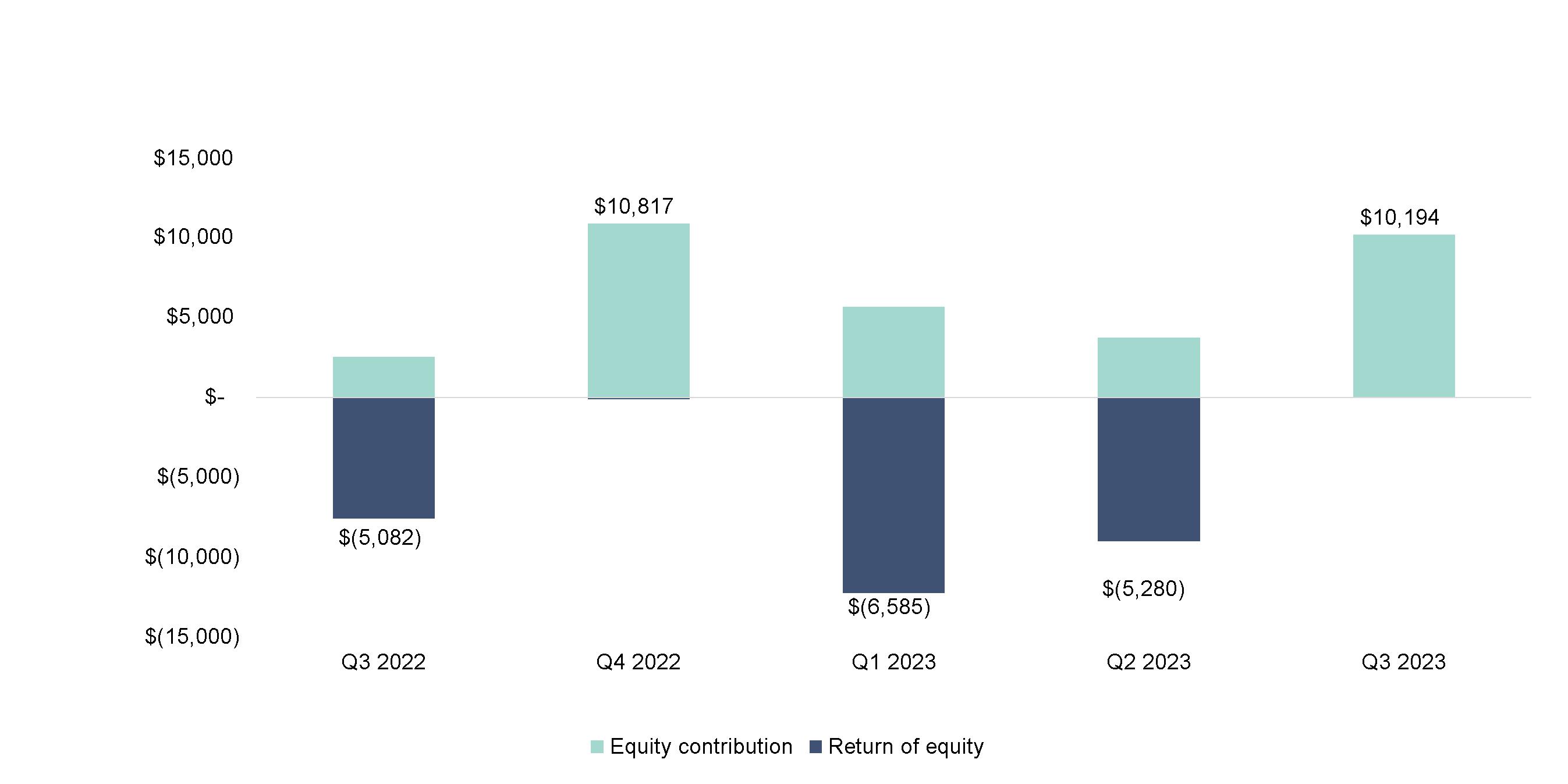

JV Equity Investments Activity

(Dollar amounts in thousands)

Quarterly Activity |

Q3 2022 |

|

Q4 2022 |

|

Q1 2023 |

|

Q2 2023 |

|

Q3 2023 |

|

|||||

JV Equity Contributions |

$ |

2,524 |

|

$ |

10,912 |

|

$ |

5,698 |

|

$ |

3,744 |

|

$ |

10,194 |

|

Return of JV Equity Contributions |

|

(7,606 |

) |

|

(95 |

) |

|

(12,283 |

) |

|

(9,024 |

) |

|

- |

|

Net JV Equity Activity |

$ |

(5,082 |

) |

$ |

10,817 |

|

$ |

(6,585 |

) |

$ |

(5,280 |

) |

$ |

10,194 |

|

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

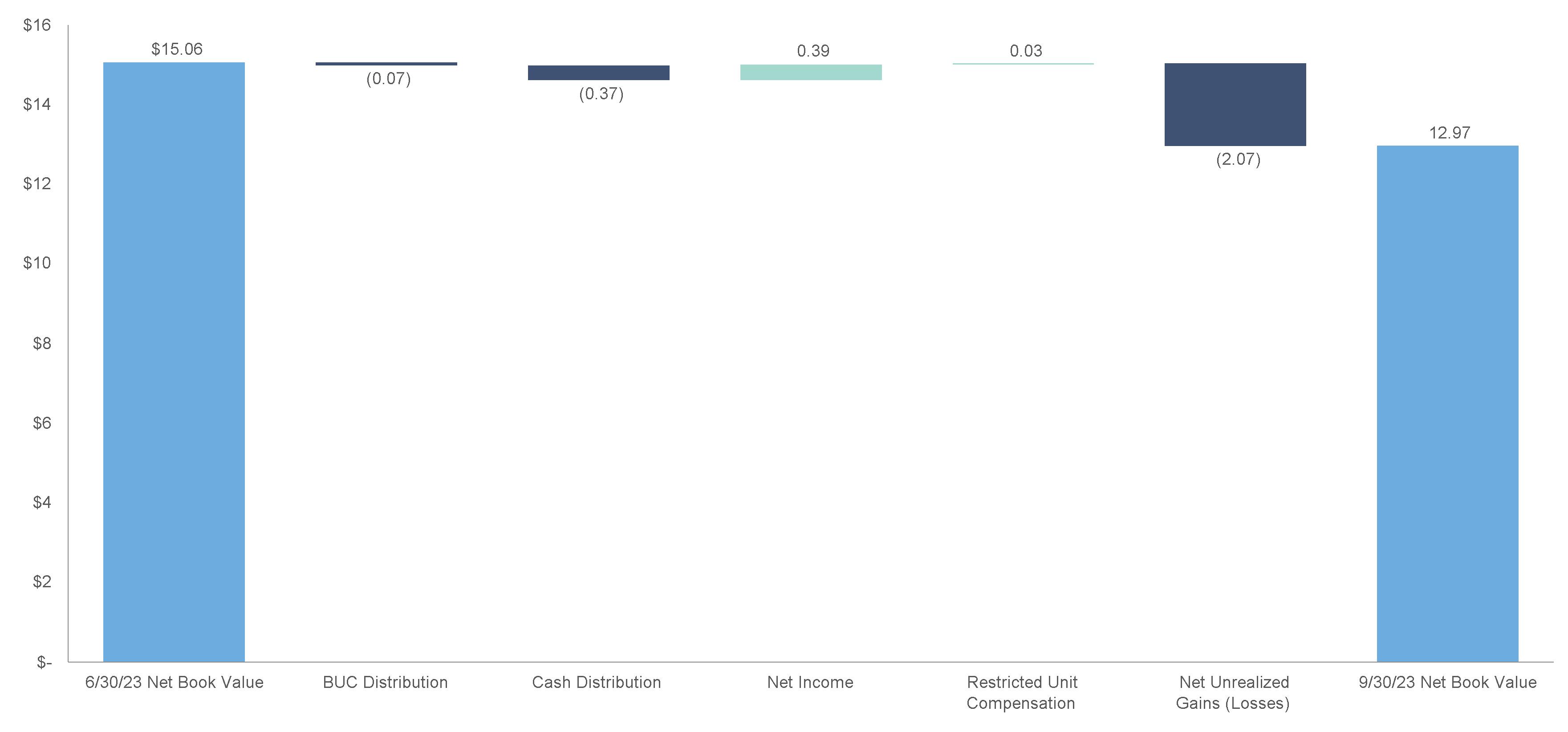

Net Book Value Waterfall

Note: Per unit data derived from weighted average BUCs outstanding during the period, except for the Net Book Values, which are based on

shares outstanding on the stated date. Numbers may not sum due to rounding.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Interest Rate Sensitivity Analysis

The interest rate sensitivity table below represents the change in interest income from investments, net of interest on debt and settlement payments for interest rate derivatives over the next twelve months, assuming an immediate parallel shift in the SOFR yield curve and the resulting implied forward rates are realized as a component of this shift in the curve and assuming management does not adjust its strategy in response. The amounts in the table below do not consider any potential derivative fair value adjustments in determining the net interest income impact.

Description |

|

- 25 basis points |

|

|

+ 50 basis points |

|

|

+ 100 basis points |

|

|

+ 150 basis points |

|

|

+ 200 basis points |

|

|||||

TOB Debt Financings |

|

$ |

1,223,811 |

|

|

$ |

(2,447,621 |

) |

|

$ |

(4,895,243 |

) |

|

$ |

(7,342,864 |

) |

|

$ |

(9,790,485 |

) |

TEBS Debt Financings |

|

|

96,944 |

|

|

|

(193,887 |

) |

|

|

(387,774 |

) |

|

|

(581,661 |

) |

|

|

(775,548 |

) |

Other Investment Financings |

|

|

(536,889 |

) |

|

|

1,073,779 |

|

|

|

2,147,557 |

|

|

|

3,221,336 |

|

|

|

4,295,115 |

|

Variable Rate Investments |

|

|

(566,796 |

) |

|

|

1,133,592 |

|

|

|

2,267,183 |

|

|

|

3,400,775 |

|

|

|

4,534,366 |

|

Net Interest Income Impact |

|

$ |

217,070 |

|

|

$ |

(434,137 |

) |

|

$ |

(868,277 |

) |

|

$ |

(1,302,414 |

) |

|

$ |

(1,736,552 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Per BUC Impact (1) |

|

$ |

0.010 |

|

|

$ |

(0.019 |

) |

|

$ |

(0.038 |

) |

|

$ |

(0.057 |

) |

|

$ |

(0.076 |

) |

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

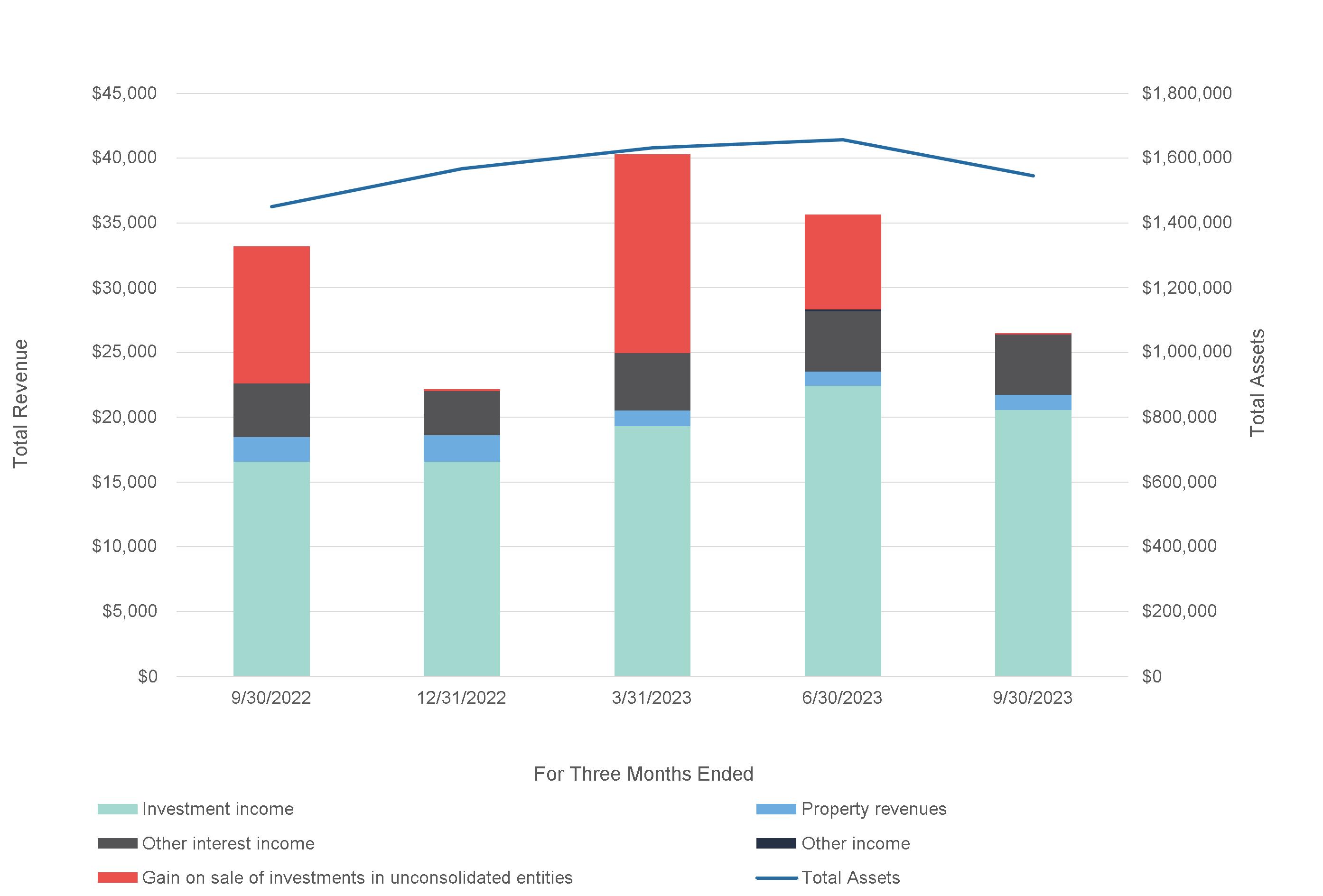

Total Revenue & Gain on Sale Trends

(Dollar amounts in thousands)

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

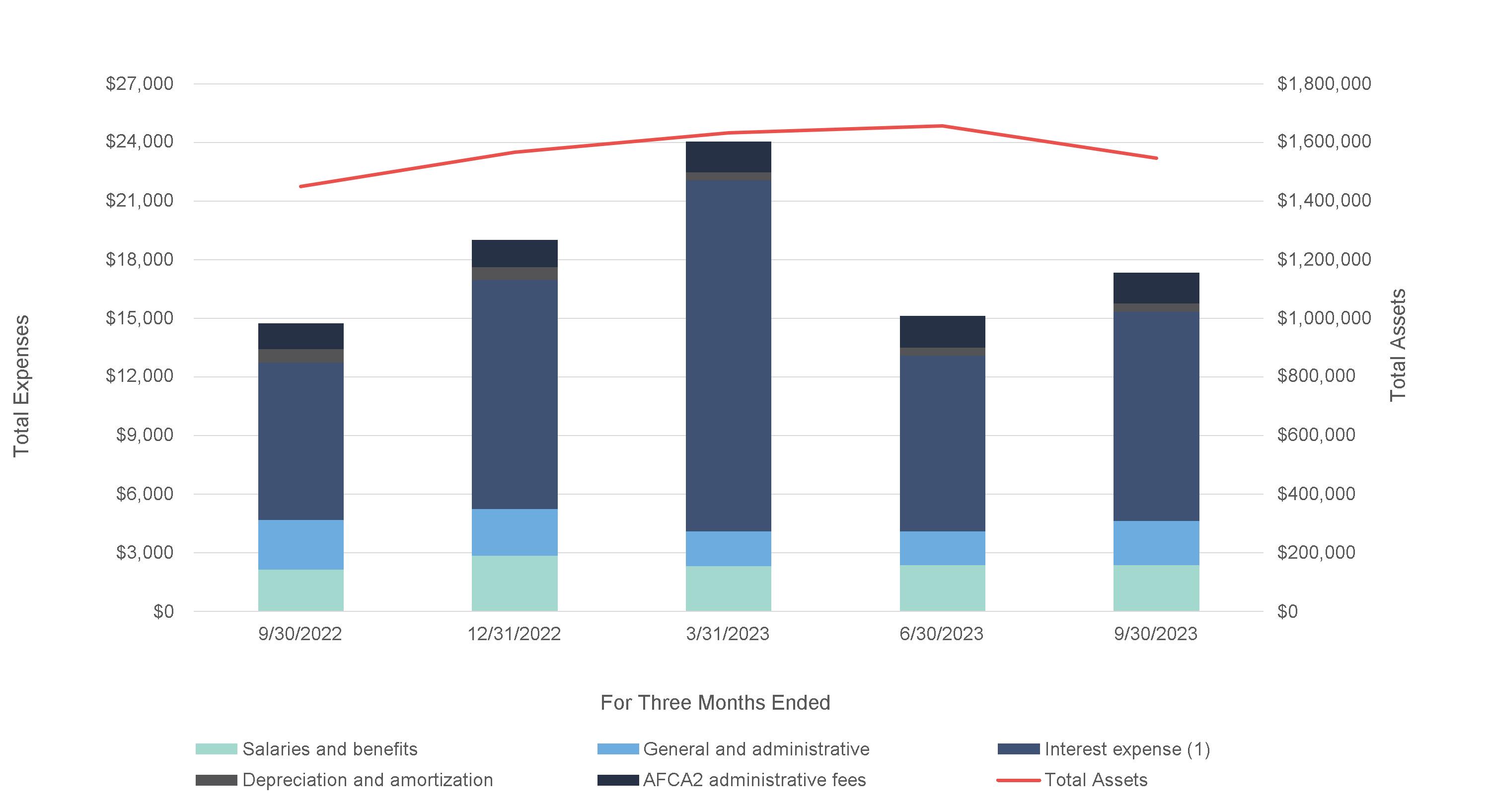

Operating Expense Trends

(Dollar amounts in thousands)

Since July 1, 2021, the sum of “Salaries and benefits” and “General and administrative” expenses as a percentage of Total Assets has

averaged approximately 0.29% per quarter.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Tax Income Information Related to Beneficial Unit Certificates

The following table summarizes tax-exempt and taxable income as percentages of total income allocated to the Partnership’s BUCs on Schedule K-1 for tax years 2020 to 2022. This disclosure relates only to income allocated to the Partnership’s BUCs and does not consider an individual unitholder’s basis in the BUCs or potential return of capital as such matters are dependent on the individual unitholders’ specific tax circumstances. Such amounts are for all BUC holders in the aggregate during the year. Income is allocated to individual investors monthly and amounts allocated to individual investors may differ from these percentages due to, including, but not limited to, BUC purchases and sales activity and the timing of significant transactions during the year.

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

|||

Tax-exempt income |

|

25 |

% |

|

|

32 |

% |

|

|

215 |

% |

|

Taxable income (loss) |

|

75 |

% |

|

|

68 |

% |

|

|

-115 |

% |

(1) |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

Unrelated Business Taxable Income

In recent years, the Partnership has generated little to no Unrelated Business Taxable Income (“UBTI”) for BUC unitholders. For tax years 2020 to 2022, the Partnership generated a net loss from activities considered to be UBTI as reported on investor Schedule K-1s. The rules around UBTI are complex, so please consult your tax advisor.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Appendices

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Operating Results Detail

(Dollar amounts in thousands, except per BUC information)

|

|

Q3 2022 |

|

|

Q4 2022 |

|

|

Q1 2023 |

|

|

Q2 2023 |

|

|

Q3 2023 |

|

|||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Investment income |

|

$ |

16,564 |

|

|

$ |

16,550 |

|

|

$ |

19,303 |

|

|

$ |

22,416 |

|

|

$ |

20,537 |

|

Property revenues |

|

|

1,914 |

|

|

|

2,070 |

|

|

|

1,226 |

|

|

|

1,108 |

|

|

|

1,199 |

|

Other interest income |

|

|

4,127 |

|

|

|

3,410 |

|

|

|

4,410 |

|

|

|

4,646 |

|

|

|

4,621 |

|

Other income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

133 |

|

|

|

117 |

|

Total revenues |

|

|

22,605 |

|

|

|

22,030 |

|

|

|

24,939 |

|

|

|

28,303 |

|

|

|

26,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Real estate operating (exclusive of items shown below) |

|

|

1,521 |

|

|

|

1,174 |

|

|

|

602 |

|

|

|

615 |

|

|

|

874 |

|

Provision for credit losses |

|

|

- |

|

|

|

- |

|

|

|

(545 |

) |

|

|

(774 |

) |

|

|

(562 |

) |

Depreciation and amortization |

|

|

688 |

|

|

|

661 |

|

|

|

405 |

|

|

|

405 |

|

|

|

413 |

|

Interest expense |

|

|

8,036 |

|

|

|

11,714 |

|

|

|

17,971 |

|

|

|

8,988 |

|

|

|

10,717 |

|

General and administrative |

|

|

4,505 |

|

|

|

5,452 |

|

|

|

5,073 |

|

|

|

5,109 |

|

|

|

5,328 |

|

Total expenses |

|

|

14,750 |

|

|

|

19,001 |

|

|

|

23,506 |

|

|

|

14,343 |

|

|

|

16,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Other Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gain on sale of investments in unconsolidated entities |

|

|

10,581 |

|

|

|

141 |

|

|

|

15,367 |

|

|

|

7,326 |

|

|

|

32 |

|

Income before income taxes |

|

|

18,436 |

|

|

|

3,170 |

|

|

|

16,800 |

|

|

|

21,286 |

|

|

|

9,736 |

|

Income tax expense (benefit) |

|

|

(82 |

) |

|

|

(6 |

) |

|

|

7 |

|

|

|

(1 |

) |

|

|

6 |

|

Net income |

|

|

18,518 |

|

|

|

3,176 |

|

|

|

16,793 |

|

|

|

21,287 |

|

|

|

9,730 |

|

Redeemable preferred unit distributions and accretion |

|

|

(716 |

) |

|

|

(716 |

) |

|

|

(747 |

) |

|

|

(799 |

) |

|

|

(700 |

) |

Net income available to partners |

|

$ |

17,802 |

|

|

$ |

2,460 |

|

|

$ |

16,046 |

|

|

$ |

20,488 |

|

|

$ |

9,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income available to partners allocated to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

General partner |

|

$ |

142 |

|

|

$ |

360 |

|

|

$ |

2,479 |

|

|

$ |

1,010 |

|

|

$ |

25 |

|

Limited partners - BUCs |

|

|

17,553 |

|

|

|

2,063 |

|

|

|

13,491 |

|

|

|

19,324 |

|

|

|

8,922 |

|

Limited partners - Restricted units |

|

|

105 |

|

|

|

36 |

|

|

|

75 |

|

|

|

154 |

|

|

|

82 |

|

Net income available to partners |

|

$ |

17,800 |

|

|

$ |

2,459 |

|

|

$ |

16,045 |

|

|

$ |

20,488 |

|

|

$ |

9,029 |

|

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Cash Available for Distribution (1)

(Dollar amounts in thousands, except per BUC information)

|

|

Q3 2022 |

|

|

Q4 2022 |

|

|

Q1 2023 |

|

|

Q2 2023 |

|

|

Q3 2023 |

|

|

|||||

Net income |

|

$ |

18,517 |

|

|

$ |

3,175 |

|

|

$ |

16,791 |

|

|

$ |

21,287 |

|

|

$ |

9,729 |

|

|

Change in fair value of derivative instruments |

|

|

(2,872 |

) |

|

|

(660 |

) |

|

|

3,436 |

|

|

|

(6,020 |

) |

|

|

(4,237 |

) |

|

Depreciation and amortization expense |

|

|

688 |

|

|

|

661 |

|

|

|

405 |

|

|

|

405 |

|

|

|

413 |

|

|

Provision for credit losses |

|

|

- |

|

|

|

- |

|

|

|

(545 |

) |

|

|

(774 |

) |

|

|

(562 |

) |

|

Realized impairment of securities |

|

|

(5,712 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Realized provision for loan loss |

|

|

(593 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Amortization of deferred financing costs |

|

|

982 |

|

|

|

611 |

|

|

|

1,006 |

|

|

|

393 |

|

|

|

353 |

|

|

Restricted unit compensation expense |

|

|

580 |

|

|

|

612 |

|

|

|

350 |

|

|

|

587 |

|

|

|

603 |

|

|

Deferred income taxes |

|

|

(43 |

) |

|

|

4 |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(1 |

) |

|

Redeemable Preferred Unit distributions and accretion |

|

|

(716 |

) |

|

|

(716 |

) |

|

|

(747 |

) |

|

|

(799 |

) |

|

|

(700 |

) |

|

Tier 2 Income allocable to the General Partner |

|

|

(70 |

) |

|

|

(337 |

) |

|

|

(2,415 |

) |

|

|

(878 |

) |

|

|

65 |

|

|

Recovery of prior credit loss |

|

|

(17 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

Bond premium, discount and amortization, net of cash received |

|

|

957 |

|

|

|

(51 |

) |

|

|

(47 |

) |

|

|

(47 |

) |

|

|

(45 |

) |

|

Total Cash Available for Distribution |

|

$ |

11,701 |

|

|

$ |

3,282 |

|

|

$ |

18,216 |

|

|

$ |

14,136 |

|

|

$ |

5,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Weighted average number of BUCs outstanding, basic |

|

|

22,247,781 |

|

|

|

22,501,386 |

|

|

|

22,538,928 |

|

|

|

22,639,852 |

|

|

|

22,734,412 |

|

|

Net income per BUC, basic |

|

$ |

0.79 |

|

|

$ |

0.09 |

|

|

$ |

0.60 |

|

|

$ |

0.85 |

|

|

$ |

0.39 |

|

|

Total CAD per BUC, basic |

|

$ |

0.53 |

|

|

$ |

0.15 |

|

|

$ |

0.81 |

|

|

$ |

0.62 |

|

|

$ |

0.25 |

|

|

Cash Distributions declared, per BUC |

|

$ |

0.37 |

|

|

$ |

0.47 |

|

|

$ |

0.37 |

|

|

$ |

0.37 |

|

|

$ |

0.37 |

|

|

BUCs Distributions declared, per BUC (2) |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

- |

|

|

$ |

0.07 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Trailing five quarter totals: |

||||||||||||||||

|

|

|

|

|

Net income per BUC, basic |

|

|

$ |

2.73 |

|

|

||||||||||

|

|

|

|

|

Total CAD per BUC, basic |

|

|

$ |

2.35 |

|

|

||||||||||

|

|

|

|

|

Cash Distributions declared, per BUC |

|

|

$ |

1.94 |

|

|

||||||||||

|

|

|

|

|

BUCs Distributions declared, per BUC |

|

|

$ |

0.54 |

|

|

||||||||||

|

|

|

|

|

|

||||||||||||||||

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Balance Sheet Summary

(Dollar amounts in thousands, except per BUC information)

|

|

9/30/2022 |

|

|

12/31/2022 |

|

|

3/31/2023 |

|

|

6/30/2023 |

|

|

9/30/2023 |

|

|||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Cash |

|

$ |

103,204 |

|

|

$ |

51,188 |

|

|

$ |

52,105 |

|

|

$ |

59,246 |

|

|

$ |

58,918 |

|

Restricted cash |

|

|

45,850 |

|

|

|

41,449 |

|

|

|

36,213 |

|

|

|

45,765 |

|

|

|

47,908 |

|

Interest receivable |

|

|

9,402 |

|

|

|

11,628 |

|

|

|

14,615 |

|

|

|

10,315 |

|

|

|

8,712 |

|

Mortgage revenue bonds, at fair value |

|

|

695,070 |

|

|

|

799,409 |

|

|

|

867,384 |

|

|

|

905,964 |

|

|

|

859,046 |

|

Governmental issuer loans, net |

|

|

281,275 |

|

|

|

300,230 |

|

|

|

315,528 |

|

|

|

302,173 |

|

|

|

254,378 |

|

Property loans, net |

|

|

123,867 |

|

|

|

175,110 |

|

|

|

162,781 |

|

|

|

142,903 |

|

|

|

115,432 |

|

Investments in unconsolidated entities |

|

|

103,103 |

|

|

|

115,791 |

|

|

|

111,135 |

|

|

|

106,296 |

|

|

|

118,525 |

|

Real estate assets, net |

|

|

58,599 |

|

|

|

36,550 |

|

|

|

35,673 |

|

|

|

35,563 |

|

|

|

35,272 |

|

Other assets |

|

|

29,717 |

|

|

|

35,775 |

|

|

|

37,236 |

|

|

|

48,458 |

|

|

|

48,140 |

|

Total assets |

|

$ |

1,450,087 |

|

|

$ |

1,567,130 |

|

|

$ |

1,632,670 |

|

|

$ |

1,656,683 |

|

|

$ |

1,546,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Accounts payable, accrued expenses and other liabilities |

|

$ |

16,366 |

|

|

$ |

21,734 |

|

|

$ |

23,408 |

|

|

$ |

22,468 |

|

|

$ |

23,622 |

|

Distribution payable |

|

|

8,313 |

|

|

|

10,900 |

|

|

|

10,835 |

|

|

|

9,322 |

|

|

|

8,481 |

|

Secured lines of credit |

|

|

30,942 |

|

|

|

55,500 |

|

|

|

6,500 |

|

|

|

12,500 |

|

|

|

16,500 |

|

Debt financing, net |

|

|

962,615 |

|

|

|

1,058,903 |

|

|

|

1,143,735 |

|

|

|

1,154,030 |

|

|

|

1,081,410 |

|

Mortgages payable and other secured financing, net |

|

|

26,231 |

|

|

|

1,690 |

|

|

|

1,690 |

|

|

|

1,690 |

|

|

|

26,513 |

|

Total liabilities |

|

|

1,044,467 |

|

|

|

1,148,727 |

|

|

|

1,186,168 |

|

|

|

1,200,010 |

|

|

|

1,156,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Redeemable preferred units |

|

|

94,453 |

|

|

|

94,447 |

|

|

|

102,430 |

|

|

|

112,421 |

|

|

|

92,428 |

|

Partners' capital |

|

|

311,167 |

|

|

|

323,956 |

|

|

|

344,072 |

|

|

|

344,252 |

|

|

|

297,377 |

|

Total liabilities and partners' capital |

|

$ |

1,450,087 |

|

|

$ |

1,567,130 |

|

|

$ |

1,632,670 |

|

|

$ |

1,656,683 |

|

|

$ |

1,546,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net book value per BUC |

|

$ |

13.88 |

|

|

$ |

14.31 |

|

|

$ |

15.12 |

|

|

$ |

15.06 |

|

|

$ |

12.97 |

|

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Important Disclosure Notices

Forward-Looking Statements

All statements in this document other than statements of historical facts, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. When used, statements which are not historical in nature, including those containing words such as “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are intended to identify forward-looking statements. We have based forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. This document may also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties contained in this supplement and, accordingly, we cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the headings “Item 1A Risk Factors” in our 2022 Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. These forward-looking statements are subject to various risks and uncertainties and Greystone Housing Impact Investors LP (the “Partnership”) expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Most, but not all, of the selected financial information furnished herein is derived from the Greystone Housing Impact Investors LP’s consolidated financial statements and related notes prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”) and management’s discussion and analysis of financial condition and results of operations included in the Partnership’s reports on Forms 10-K and 10-Q. The Partnership’s annual consolidated financial statements were subject to an independent audit, dated February 23, 2023.

Disclosure Regarding Non-GAAP Measures

This document refers to certain financial measures that are identified as non-GAAP. We believe these non-GAAP measures are helpful to investors because they are the key information used by management to analyze our operations. This supplemental information should not be considered in isolation or as a substitute for the related GAAP measures.

Please see the consolidated financial statements we filed with the Securities and Exchange Commission on Forms 10-K and 10-Q. Our GAAP consolidated financial statements can be located upon searching for the Partnership’s filings at www.sec.gov.

Other Information

On September 14, 2022, the Partnership declared a supplemental distribution payable in the form of additional BUCs equal to $0.20 per BUC (the “Third Quarter 2022 BUCs Distribution”). The Third Quarter 2022 BUCs Distribution was paid at a ratio of 0.01044 BUCs for each issued and outstanding BUC as of the record date of September 30, 2022, which represents an amount per BUC based on the closing price of the BUCs on the Nasdaq Stock Market LLC on September 13, 2022. The Third Quarter 2022 BUCs Distribution was completed on October 31, 2022.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

On December 19, 2022, the Partnership declared a supplemental distribution payable in the form of additional BUCs equal to $0.20 per BUC (the “Fourth Quarter 2022 BUCs Distribution”). The Fourth Quarter 2022 BUCs Distribution was paid at a ratio of 0.0105 BUCs for each issued and outstanding BUC as of the record date of December 30, 2022, which represents an amount per BUC based on the closing price of the BUCs on the New York Stock Exchange ("NYSE") on December 16, 2022. The Fourth Quarter 2022 BUCs Distribution was completed on January 31, 2023.

On June 14, 2023, the Partnership declared a supplemental distribution payable in the form of additional BUCs equal to $0.07 per BUC (the “Second Quarter 2023 BUCs Distribution”). The Second Quarter 2023 BUCs Distribution was paid at a ratio of 0.00448 BUCs for each issued and outstanding BUC as of the record date of June 30, 2023, which represents an amount per BUC based on the closing price of the BUCs on the NYSE on June 13, 2023. The Second Quarter 2023 BUCs Distribution was completed on July 31, 2023.

On September 13, 2023, the Partnership declared a supplemental distribution payable in the form of additional BUCs equal to $0.07 per BUC (the “Third Quarter 2023 BUCs Distribution”, collectively with the Third Quarter 2022 BUCs Distribution, the Fourth Quarter 2022 BUCs Distribution, and the Second Quarter 2023 BUCs Distribution, the “BUCs Distributions”). The Third Quarter 2023 BUCs Distribution was paid at a ratio of 0.00418 BUCs for each issued and outstanding BUC as of the record date of September 29, 2023, which represents an amount per BUC based on the closing price of the BUCs on the NYSE on September 12, 2023. The Third Quarter 2023 BUCs Distribution was completed on October 31, 2023.

There were no fractional BUCs issued in connection with the BUCs Distributions. All fractional BUCs resulting from the BUCs Distributions received cash for such fraction based on the market value of the BUCs on the record date.

Unless noted otherwise herein, the BUCs Distributions have been applied retroactively to all net income per BUC, distributions per BUC and similar per BUC disclosures for all periods indicated in this supplemental financial report.

© 2023 Greystone & Co. II LLC |

|

Supplemental Financial Report for the Quarter Ended September 30, 2023

|

|

Other Partnership Information

Corporate Office: |

|

|

Transfer Agent:

|

|

14301 FNB Parkway |

|

|

American Stock Transfer & Trust Company |

|

Suite 211 |

|

|

59 Maiden Lane |

|

Omaha, NE 68154 |

|

|

Plaza Level |

|

Phone: |

402-952-1235 |

|

New York, NY 10038 |

|

Investor & K-1 Services: |

855-428-2951 |

|

Phone: 718-921-8124 |

|

Web Site: |

www.ghiinvestors.com |

|

888-991-9902 |

|

K-1 Services Email: |

ghiK1s@greyco.com |

|

|

|

Ticker Symbol (NYSE): |

GHI |

|

|

|

Corporate Counsel: |

|

Independent Accountants: |

Barnes & Thornburg LLP |

|

PwC |

11 S. Meridian Street |

|

1 North Wacker Drive |

Indianapolis, IN 46204 |

|

Chicago, Illinois 60606 |

|

|

|

Board of Managers of Greystone AF Manager LLC: |

||

(acting as the directors of Greystone Housing Impact Investors LP) |

||

|

|

|

Stephen Rosenberg |

Chairman of the Board |

|

Jeffrey M. Baevsky |

Manager |

|

Drew C. Fletcher |

Manager |

|

Steven C. Lilly |

Manager |

|

W. Kimball Griffith |

Manager |

|

Deborah A. Wilson |

Manager |

|

Robert K. Jacobsen |

Manager |

|

|

|

|

Corporate Officers: |

||

Kenneth C. Rogozinski |

Chief Executive Officer |

|

Jesse A. Coury |

Chief Financial Officer |

|

© 2023 Greystone & Co. II LLC |

|